CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

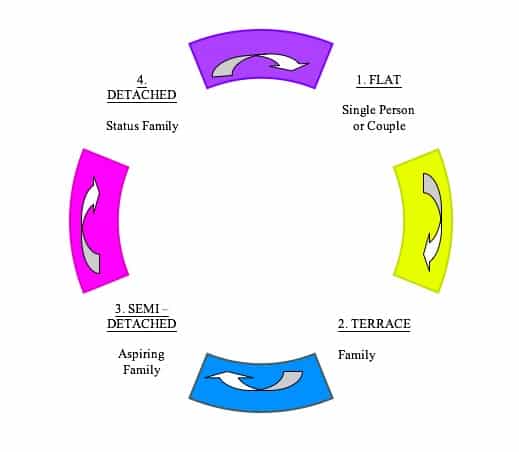

The property clock has a typical duration of anywhere between 3 and 10 years. There are longer durations that exist, typically 40 years+, wthin our own home ownership goals. If we understand this cycle, which I call the Lifetime Property Clock, we can then have a whole understanding of the property market. This is because the property market is made up of investors following the 'Property Clock' and owner occupiers following the 'Lifetime Property Clock' who look for a home to live and bring up their family in. Look at the following diagram:

We can see that there is a definitive clock that exists within our own personal property goals over our lifetime. Looking at the detail of each stage of the clock:

We can see that there is a definitive clock that exists within our own personal property goals over our lifetime. Looking at the detail of each stage of the clock:

- Single Person or Young Couple – Age 20 to 30 years old

We start our working life, but more specifically receiving a pay packet and start spending what we earn on all sorts of products and services like clothes, electrical items, eating out etc. But we do all this from our parents home! There then comes a point when you want your own place as it doesnt look that cool having the latest designer gear, the porsche, but still living in your bedroom that you have done so since you were born! A 'pad' is needed to prove that you are independent. At this time the single person turns in to a first time buyer. Now there will be scenarios where a couple get together to buy for the first time and they will also fit under this category.

First time buyers (being single people and young couples) will want to preserve as much disposable income as possible. This is because it is the younger working generations that like to spend in the bars, clubs, restaurants, high streets and travel agents and they need the money to do so. So they will aim to buy a property that:

- Is cheaper than paying rent

- Is not surplus to their needs

- Easy to maintain

The properties that meet this criteria will be the at the cheaper end of the market. Specifically they will be studio, 1 and 2 bed flats. Invariably these type of properties will be cheaper than the terraced, semi’s and detached properties. There will be exceptions to this rule. Consider the cost of riverside luxury apartments and penthouses compared to the cost of ex-local authority houses. The riverside flats will be more expensive than the terraced and semi-detached properties but it will be likely that the buyer of these flats will not be your typical buyer. It may be a second home for a wealthy business man or a second or third time buy by a young professional moving up the corporate ladder. It could be the case that the lifetime property clock for some individuals will only ever consist of flats but these cases will be rare and can be eliminated from this clock as we are dealing with the norms. They will also be smaller than all the other property types and maintained by someone else typically the freeholder.

So first time buyers will be drawn to flats. This can be seen by the way newly constructed flats are marketed. The show flat is decorated to a modern standard as the developer knows that the typical buyer of the flats will be young so he has to make the show flat appeal to the young. Second bedrooms are dressed up as study rooms rather than baby rooms. Living rooms are larger at the expense of the kitchen as the developer knows that the young often eat out and prefer a larger living space.

So it is established that flats are typically bought by first time buyers. I have assumed that a first time buyer is NOT a young family. There may be some young families that do look to get on the property ladder but again, we are working within norms. An example of this would be Jack:

Jack has £8,000 saved and earns £18,000 per year. In his area he sees flats going for around £75,000 and houses going for £120,000 plus. His buying power is calculated as:

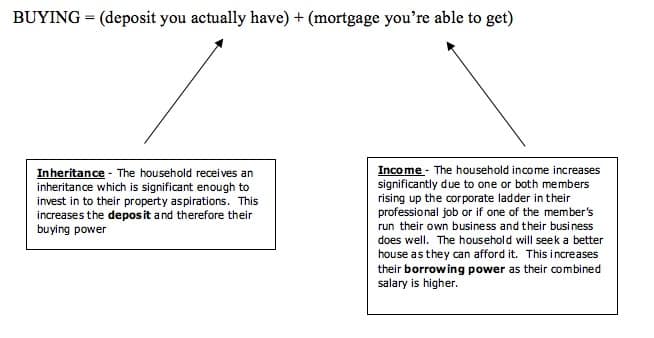

BUYING POWER = (deposit you actually have) + (mortgage you’re able to get)

To calculate what he can afford we just plug in the figures. The deposit is £8,000 and the mortgage he is able to get will be 4 times his salary. So buying power is calculated as:

BUYING POWER = £8,000 + (4 x £18,000)

Which equates to £80,000. So we can see he can clearly only afford a flat. So he buys a nice 1 bed flat near the town for £80,000.

So as nature follows its natural course the first time buyer:

- if it’s a single person meets the love of their life and decides to have a family

- if it’s a couple decide to have a family

It becomes apparent that having your children sleep in the same room as you do is not such a good idea! A bigger property is required, preferably with a garden for the child or children to play in. Therefore a house is needed………

- Family – Age 30 to 40 years old

It is probable that two things would have happened to the first time buyer since moving to now:

- Equity Increase – The flat that the first time buyer owns would have grown in value. This would mean that instead of the mortgage balance being around 90% of the value of the home the balance will be somewhere around 40 – 80% of the value depending on timing and how the market has performed. There may be a situation where the mortgage balance is greater than the property value (called negative equity) but if this situation had occurred the couple simply have to wait it out until prices recover so that they can move. Therefore people in this situation cannot be second time buyers as they are stuck in their homes unable to participate in the market.

- Salary Increase – It is likely that the first time buyer’s salary would have increased due to promotion, career progression etc. This means that the first time buyer can borrow more to acquire his second property.

Due to both of these things happening the first time buyer can buy a better property – a house! This is because he now has a larger deposit due to an increase in equity and increased borrowing power due to an increase in salary. Using the same example above lets say Jack, 5 years down the line, meets Jill (who also owns her flat and bought at the same time), his next door neighbour, and the get married and decide to plan a family. They decide to sell both their flats, use the equity in their flats and combine their salaries to buy a nice 3 bed terrace property in the same town.

| Jack | Jill | Total | |

| Value of flat | £100,000 | £100,000 | £200,000 |

| Mortgage Balance | £72,000 | £72,000 | £144,000 |

| Equity | £28,000 | £28,000 | £56,000 |

| Salary | £23,000 | £23,000 | £46,000 |

So their buying power follows the same equation:

BUYING POWER = (deposit you actually have) + (mortgage you’re able to get)

The deposit is £56,000 and the mortgage they will be able to get will be 2.75 times joint salary. So buying power is calculated as:

BUYING POWER = £56,000 + (2.75 x £46,000)

Which equates to £182,500. So Jack and Jill buy the nice 3 bed terrace that they had their eye on for £182,500 and start a family.

The majority of the population will stop here. The second time buy house will meet all their basic needs like a room for each child, space for a decent dining table, garden etc. The aims for the family will be to clear the mortgage by the time they hit retirement age or before. The only time a second time buyer becomes a third time buyer is when:

- Another Child - The household outgrows the house due to the arrival of another child

- Income - The household income increases significantly due to one or both members rising up the corporate ladder in their professional job or if one of the member’s run their own business and their business does well. The household will seek a better house as they can afford it.

- Inheritance - The household receives an inheritance which is significant enough to invest in to their property aspirations.

In the first instance, where the family outgrows the house, the household income would not have changed so the household can only afford a house that they currently live in. The household will move to house of the same value but it will be larger. The household may forgo such benefits of the original house such as proximity to the town centre, train station or quality of area to obtain the larger house. This type of third time buyer will buy another terraced house with simply more bedrooms for the same price like moving from a 3 bed private terrace to a 4 bed ex-local authority house. So here there is no progression in price. Its more like a sideways move within the lifetime property clock.

In the second and third instance there is a progression in price. A higher value property is sought. This is a valid third time buyer as they are moving upwards in the property market. This is what I call the aspiring family.

- Aspiring Family – Age 35 to 55 years old

So the two scenarios where a household is able to move up the property ladder are when their buying power increases further. Looking at the buying power equation and seeing where each situation occurs are as follows:

So using the same example, suppose Jack & Jill were to qualify to make consultant level at their office jobs with a 80% increase of their salary then their individual pay will go from £23,000 to £41,400. Then the mortgage they are able to get increases from:

So using the same example, suppose Jack & Jill were to qualify to make consultant level at their office jobs with a 80% increase of their salary then their individual pay will go from £23,000 to £41,400. Then the mortgage they are able to get increases from:

2.75 x (£23,000 + £23,000) = £126,500

to

2.75 x (£41,400 + £41,400) = £227,700

That’s an increase of £227,700 - £126,500 = £ 101,200.

So now Jack & Jill can look at a house, assuming property prices have remained at the same level, for £101,200 greater than what their house is worth which equates to £182,500 + £101,200 = £283,700. This will probably buy them a nice 4 bed semi or 3 bed detached in a private area. The same house could be bought if there was no increase in salary but Jack’s remaining parent leaving £101,200 on their death.

Most third time buyers will stop here. It will be a quiet and safe enough area to enjoy a happy life for them and their children. The only family left looking to move again is the Status Family……

- Status Family – Age 40 to 60 years old

So what makes someone want to buy for the fourth time? Status! If the property they live in is meeting all their needs then the mind slowly turns ‘wants’ in to ‘needs’. Like:

I need a triple garage to house my three cars as they might get stolen

I need a swimming pool and gym to keep fit for my health

I need a large garden so my children can play safely

I need a separate study room as it will better my ability to work

I am guilty of this! I want a house with a triple garage, swimming pool, large garden and separate office. I have convinced myself I need it but if I’m honest with myself I don’t really need any of this. I am a single man and all I need is a 1 bed flat however it hasn’t stopped me looking for this type of property as I believe my life will be better if I do find such a property.

The buying power will be calculated the same as above. The figures can be anything as houses at this end of the market can range from £500,000 to £100m. There are very few executive houses relative to the number of other houses and the worth of these houses will be determined by very different fundamentals. Where the value of a 3 bed terrace will be comparable to another 3 bed terrace in the same street and there will be plenty of buyers executive homes have no comparables and very few buyers. Values of executive homes will be set by holding out for a buyer to fall in love with the house.

Take for example an executive home on the market for £1m. How many buyers do you think there are able to buy this home? Very few – that’s for sure! The potential buyer will have to love the area, layout, space, style and much more if he is going to part with a large sum of money like a million pounds. So the vendor simply has to wait. If the vendor is in a hurry to sell he has to either drop his price to attract more potential buyers or improve the property’s finish but you find at the top end there are few vendors that require a quick sale.

It can be assumed that once someone is over 60 years of age they will be unlikely to want to move upwards in the property market. If anything, once a spouse dies, the remaining spouse leaves the home to move into a serviced retirement flat. So in effect moves round to position 1 again being the single person.

Forced Moves

I have ignored forced moves. That is to say moving house due job relocation, divorce or sizing down. This is to keep the model simple. All these forced moves have an impact to the market but it is safe to say that people strive to move round the lifetime property clock in a clockwise fashion.