CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

Calculating Yield

So how does a professional investor know that a property purchase is going to put money in his pocket? Well its called yield. Yield is defined as:

‘what you get out relative to what you put in’

Lets look at this in more detail. Yield really has only two key variables:

- What you get out

- What you put in

So to calculate yield you simply divide what you get out by what you put in and express it as a percentage. In mathematical terms:

What you get out x 100.

What you put in

1.What You Get Out

So what do you get out from property? – RENT! But its not just as simple as that. You have to consider the expected rent to be received and expected costs. But does the professional investor include capital growth? – NO! This is because it is unknown even though the professional investor may have an inkling. So the output for a professional investor is:

| What you get out | Term | Definition |

| Annual Rent – Annual Interest Cost – Expenses - Tax | Annual Rent | This is the amount you expect to receive from your tenant for use of your property only. You do not include any payments from your tenant that are considered expenses such as water rates or council tax if you do include this in your rent. You calculate it on an annual basis as returns are always calculated annually – its industry standard. You assume a full year with no void periods. Void periods are dealt with below. |

| Annual Interest Cost | This is the annual amount you pay to the bank as a result of obtaining borrowings to purchase the property. Essentially it is the monthly mortgage payment you pay on an interest only basis multiplied by twelve. | |

| Expenses | Typical expenses will be:

Its good to calculate this output as it will determine whether it is a good investment. If the output is not what was expected then you can walk away from the deal. If it meets your expectation or even surpasses it then its worth considering. This output is commonly called the expected net profit of an investment. We would hope that this figure is positive! | |

| Tax | Unfortunately we all have to pay tax. Tax is an unavoidable expense. Things to consider when taking into account the amount of tax you’ll have to pay are:

Tax free investments benefit the higher rate tax payers the most. Tax free investments such as ISAs and Private Pensions are out there as alternatives to property investments. You have to look at the yields from these investments and compare them to property. I can tell you now that property yields way in excess of any other of these investments but ultimately its up to you where you invest! | |

What you get out should only ever be assessed by what you put in. So lets look at what you put in.

2.What You Put In

Well you can be assured that you’ll have to put in some of your hard earned cash! But how much depends on what you’ve got and how much you’re willing to borrow. There can only ever be two sources for investment – your cash and borrowed cash. Decide which one of the three type of investors you are to then decide which yield calculation is applicable to you. Lets look at the following table:

| Investor | What you put in | Your Cash | Borrowed Cash | Description |

| High Risk Investor | Nil | None | Purchase price + Acquisition costs = Total cost of investment | Here you still put in nothing! The difference is that you borrow the whole of the cost of the investment. That is the deposit, the mortgage amount, solicitor costs, arrangement fees and valuation fees by way of a mortgage and unsecured borrowings. On the surface the yield would again be infinity. However because you have borrowed all the money your ability to service the debt will be dependent on the yield so yield becomes very important. In fact out of all these three classes the yield of the investment is the most important as it has to be compared to the average interest rate you’re borrowing at. If the yield is lower than the average rate then the investment will lose money. See further below. |

| Medium Risk Investor | Some | Deposit + Acquisition costs | Purchase price – deposit = Mortgage | This is the normal way people invest in property. You put in some but the bank put in the lion share. Typical ratios of your money to the bank’s money are anywhere between 15:85 to 40:60. So ultimately you want to know what return you expect to get on your own money invested. This is called Return On Capital Employed (ROCE). Capital being another name for your own personal contribution to the investment. |

| Low Risk Investor | All | Purchase Price + Acquisition costs | None | If only! This investor is rich enough to fund the whole purchase price and acquisition costs from their own savings. There are no borrowings. This investor needs to calculate the yield so he or she can make a direct comparison with other investments. |

So to calculate yield, as mentioned above, you simply divide what you get out by what you put in and express it as a percentage:

What you get out x 100.

What you put in

So the magic calculations that need to be computed, based on what you put in and get out detailed above, are:

| Investor | Calculation | Description |

| High Risk Investor | (Annual Rent – Annual Mortgage Cost – Annual loan cost – Expenses - Tax) x 100. Deposit + Acquisition Costs

| This is the real cashflow inward to you after every expense including tax relative to what you theoretically put in. It includes the borrowing cost of both the mortgage and the unsecured loan obtained to purchase the property. Even though you have put in nothing you have to assess whether the money you borrowed on an unsecured basis is returning you a good yield. |

| Medium Risk Investor | (Annual Rent – Annual Mortgage Cost – Expenses - Tax) x 100. Deposit + Acquisition Costs

| Unlike the high risk investor there is no annual unsecured loan cost as you have put in your savings. You need to know whether the yield is better than keeping your money in the bank. |

| Low Risk Investor | (Annual Rent - Expenses - Tax) x 100. Property Purchase Price + Acquisition Costs

| Unlike both investors above there is no borrowing cost. However you need to know whether the yield is better than keeping your money in the bank. |

An Example

So lets look at an example to calculate the yields:

Tom, Dick & Harry are all higher rate tax payers but they have very different risk profiles. They see a property advertised for £100,000 but all have very different strategies to buy the property.

| Tom | High Risk Investor | Tom will borrow £27,000 on an unsecured basis to raise the deposit of £25,000 and £2,000 acquisition costs. He will then obtain the other £75,000 by way of a mortgage to purchase the property. |

| Dick | Medium Risk Investor | Dick will fund the deposit and acquisition costs from his savings. He will then obtain the other £75,000 by way of a mortgage to purchase the property. |

| Harry | Low Risk Investor | Harry will fund the property price and acquisition costs with his savings. |

They estimate that it can rent out for £1,000 per calendar month. They also estimate the following annual expenses to derive a profit and loss account:

| Tom | Dick | Harry | |

| Rent | £12,000 | £12,000 | £12,000 |

| Unsecured Borrowing Costs (interest only) | £1,750 | N/A | N/A |

| Mortgage Costs (interest only) | £4,500 | £4,500 | N/A |

| Void Periods | £1,500 | £1,500 | £1,500 |

| Service Charges&Ground Rent | £1,000 | £1,000 | £1,000 |

| Repairs | £500 | £500 | £500 |

| Agents Fees | £1,050 | £1,050 | £1,050 |

| Sundry | £450 | £450 | £450 |

| Profit | £1,250 | £3000 | £7,500 |

| Tax @ 40% | £500 | £1200 | £3,000 |

| Net Profit | £750 | £1800 | £4,500 |

So the yields for each investor are:

| Investor | Calculation | Result |

| Tom - High Risk Investor | (Annual Rent – Annual Mortgage Cost – Annual loan cost – Expenses - Tax) x 100. Deposit + Acquisition Costs

£750 x 100 £27,000 | 2.8% |

| Dick - Medium Risk Investor | (Annual Rent – Annual Mortgage Cost – Expenses - Tax) x 100. Deposit + Acquisition Costs

£1800 x 100 £27,000 | 6.7% |

| Harry - Low Risk Investor | (Annual Rent - Expenses - Tax) x 100. Property Purchase Price + Acquisition Costs

£4500 x 100 £102,000 | 4.4% |

Now all these yields are positive so the property purchase is expected to put money in the investors pocket. Depending on each of Tom, Dick and Harry’s thresholds for investment will determine whether they will buy. So for example if Tom’s threshold is 4% to buy then he will not as the investment is below his 4% threshold. If Harry’s threshold is 4% then Harry will buy as his yield is above his threshold. All of their thresholds will be based on their own personal criteria and alternative investments. But you can be assured that if the yields were negative then the professional investor would NOT be interested. This is because the investment will take money out of his pocket.

Understanding +/- Yield

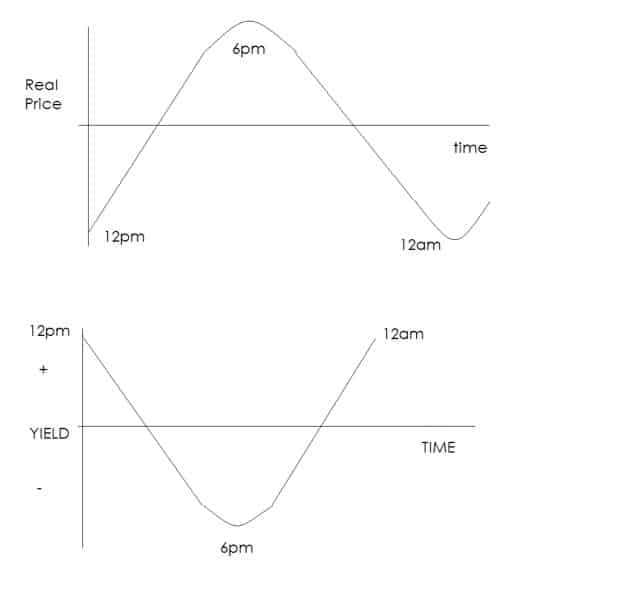

Well its obvious to see that when the clock strikes 12pm then you are winning on both counts. That is to say that:

- The yield is positive and at its highest point

- The capital growth is positive and at its highest point

Looking at 12pm graphically:

So we can see that at 12pm the price of the property is at its lowest real price. As a result of this the yield is at its highest. Now due to the fact that rental prices are directly proportional to wages, which rise religiously with inflation, we can show that it’s the property price alone that drives the yield. In other words the yield is only high due to the property purchase price being ARTIFICIALLY low due to market conditions.

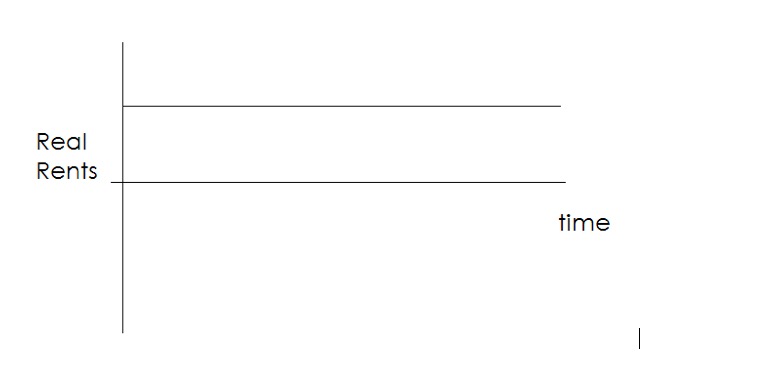

You have to draw on your own experiences to really believe what I’m saying. Just because house prices have risen by 20% in a year - do you ever see rental prices rising accordingly? – probably not. Rental prices are directionally proportional to wages. This makes sense. If you had volatile rental prices you would find that people would be on the streets! If interest rates rose dramatically, landlords would raise their rents to meet their mortgage payments and then ‘forget’ to reduce them as their mortgage payments fell. So as we have eliminated inflationary influences from this model we would have the rent vs time graph looking like:

So we can see that rents do not change over time. Another great thing about rents are that they are:

- Known and

- Predictable

They are known as it is very easy to gather the market rental value for a 1, 2 or 3 bed property as there should be plenty of these type of properties to rent on the market. As long as the property you are thinking of buying is not unique in any way then the market rental value will be easily comparable to similar properties on the market. The rental market will not entertain a property that is over priced on rent as the tenant will simply go elsewhere. So the market rent of a property will fall within a small range.

They are predictable as rental values only every increase with wage inflation. So we can assume that the rents will rise but only modestly. Since we are ignoring inflation we can predict that rents will remain the same in real terms.

So using the graphs above we can see that over the four key points on the clock the yield is the inverse to the property purchase price, in other words, as property prices increase yields decrease:

| 12pm | 3pm | 6pm | 9pm | |

| Property Price | £50,000 | £116,667 | £233,333 | £116,667 |

| Annual Rent | £10,000 | £10,000 | £10,000 | £10,000 |

| Annual Mortgage Cost @ 6% interest of property price | £3,000 | £7,000 | £14,000 | £7,000 |

| Other Costs | £3,000 | £3,000 | £3,000 | £3,000 |

| Net Yield | £7,000 | £nil | (£7,000) | £nil |

So we can see that its property prices that drive yield. In other words:

THE PROPERTY PRICE IS EVERYTHING!

So knowing that the property price is everything we theoretically can ignore the yield curve as it is simply as a result of the property price curve. An analysis of the property prices is essential if we want to gain heavily – so read on!