CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

6pm…Its getting cold

So now we have owner occupiers buying properties that are too small for what they’re worth and owner occupiers with high income multiple mortgages but not a speculative or professional investor in sight. The market has gone stagnant. Renters are unwilling to buy and move in to a property that is smaller than what they are renting, owner occupiers are stuck in to a property that is not growing as before, speculative investors are not interested because on the face of it there is no gain to be had and the professional investor had long gone due to it being unprofitable at 3pm. So who is left buying? – The owner occupier! The owner occupier is overstretching themselves by accepting unsuitable properties or going to high income multiple lenders (the self certified borrower who has lied about his income is also buying but this is a small percentage of the overall buyers at 6pm).

The enevietable is about to happen. Interest rates will rise. This is the only thing that can jolt the market. Now I’m not saying a few quarter point interest rate rises. I’m talking about a 2%+ rise from its lowest point. This is when it begins to hurt.

Two terms then start to rear their ugly heads (in order):

- Negative Equity

- Repossession

Negative Equity

This, in simple terms, is when the mortgage balance is greater than the value of the house. This in itself is not a problem over the long term as the value of the house will recover. It is a big problem for:

- Owner Occupiers who wish to move

- Lenders wishing to access their security on defaulting borrowers

- The Economy due to feel good factor being lost hence a reduction in spending

- The Property Market as less property deals are done thus estate agents, brokers and other industries surrounding the property market feel the pinch.

Repossession

This is when the lender legally enforces the sale of a property they have lent on due to the borrower defaulting on their mortgage payments. This situation occurs when:

- Interest rates rise making the mortgage repayments unaffordable

- Job losses within the household so the mortgage payments become unaffordable.

The number of repossessions occurring every month are directly related to the economy as repossessions are a function of interest rates and job losses. So if interest rates rose to 20% and/or everyone lost their job then everyone would get repossessed and lose their home. If interest rates were 0% and unemployment rates are 0% then no one would lose their home. We are somewhere in between.

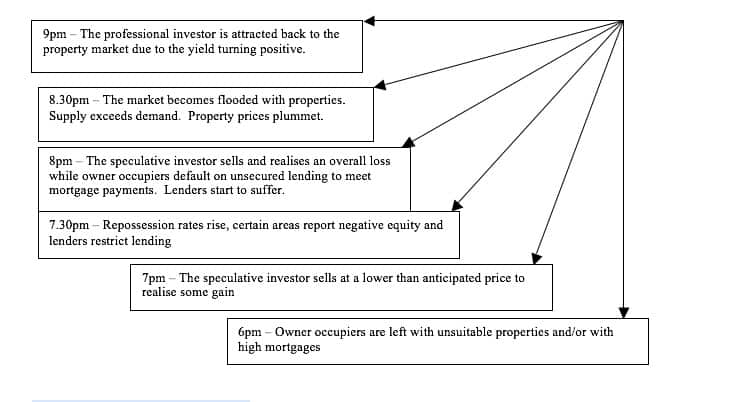

6pm to 9pm

So at 6pm we only have the owner occupiers buying. The owner occupier buying unsuitable properties at inflated prices or obtaining finance from high income multiple lenders. Property prices now reach their maximum. This is due to married (or co-habiting) owner occupiers unable to buy as lending is restricted to 2.75 times joint salary or individual owner occupiers restricted to 4.93 times salary. Speculative investors unable to buy as lending is restricted to 130% of the mortgage payment. The buyers at 6pm are the last weight of buyers and are buying at the peak. As usual the private individual is the one that suffers – he buys high and is forced to sell low. These buyers have not factored in interest rate rises as well as owner occupiers that have previously bought and accessed their equity from high income-multiple lenders (greater than 4 times) and 2nd charge lenders with less strict lending criterias. They have ignored warnings that rates will rise.

Rates do begin to rise, but only modestly, to attract overseas investment in government gilts to fund the deficit being experienced as a result of over consumption. The press start to hint of negative equity to spread across thousands of households in the future due to the now upward trend of interest rates. Repossession rates are followed closely by the press to see if they are increasing month by month. If there is an increase you can be sure its front page news on some of the tabloids. A sense of fear sets in even though there has been no real change in property prices. Properties for sale remain in the windows of estate agents with none of the vendors willing to drop their prices (because they don’t have to) and none of the buyers able to afford what is for sale.

TV ads for loans start to decline. Stories of how people have made a fortune in property now seem stale and also unrealistic within the current environment. Some speculative investors that were breaking even are now losing money due to the slight increase in interest rates. The speculative investor is not forced to sell (due to the loss being only small and manageable) but chooses to sell as the investment is taking money out of his pocket and he can bank a gain if he sells now. So several properties come on to the market requiring a quick sale from the speculative investors. As they already have a gain locked in the speculative investor will reduce their price for a genuine quick sale. Property prices start to reduce and creep back to affordable levels. Some speculators are lucky and sell to frustrated owner occupiers dying to get on the property ladder. Other speculative investors are not so lucky as owner occupiers get wise and think its better to wait and see if prices drop further or if a better property comes on to the market……..

Rates rise again. And again. Repossession rates have risen for the first time and its splashed over the press. Certain areas are reported to be in negative equity. The owner occupier seeking a home to buy is now smiling as he thinks property prices will drop further. Estate agents are convincing their vendors to reduce their prices to attract people through the door. Lenders are losing as a result of the repossessions as after all legal costs have been taken in to account the monies raised from the sale do not cover the amount they lent and all other costs of repossession. Lenders start to restrict lending. This further stagnates the market. Property prices fall further.

2nd charge lenders and unsecured lenders start experiencing defaults due to the borrower choosing to pay their mortgage rather than their 2nd charge and unsecured debts. Regret for the holidays and cars that were bought with this money start to set in. People start to restrict what they spend on the high street and try to liquidise some of the assets bought with their remortgaged money. Suddenly saving seems better than spending! The feel good factor has now been lost. Property prices start falling further due the lack of buyers.

Speculative investors are now happy to get back what they had paid for the property as it is better to get rid of a property that is costing them every month. The gain once promised from these properties fail to materialise. Some speculative investors actually lose capital to obtain a quick sale. Property investment starts to get a bad name. Some speculative investors see some of their hard earned savings lost to free them from the bind of the poor performing investment property or properties.

Rates rise further. Repossession rates rise further. Everyone is now in negative equity that had bought at 6pm. More and more owner occupiers are struggling to pay their mortgages and they want to sell. The market gets flooded with properties for sale by desperate vendors. The problem is it is neither a buyers market nor a sellers market! Some are lucky and sell to other owner occupiers others are not so fortunate and get repossessed. All the owner occupiers that had overstretched themselves by over borrowing can no longer meet the higher repayments as a result of the interest rate rises. Supply of property is now well in excess of demand. Prices have to fall even further.

The only real saviour to this falling market with any kind of buying clought to prevent the price falling to ridiculous levels is the professional investor. At 9pm he sees that prices have fallen to a level where if he were to buy the purchase will put money in to his pocket at a rate greater than leaving the money in the bank EVEN though property prices are falling. So, the clock strikes 9pm. Welcome back the professional investor.

Looking at it as a sweeping hand of the clock:

Strategies Within A Coldspot

There is no money to be made here. Anything you buy will take away what ever you put in by way of a deposit and take money out of your pocket every month – ouch! If an area is a coldspot then simply avoid it. If you own a property in a coldspot and you can get out with a gain then do so. If you own a property in a coldspot and cannot get out with a gain then oh dear! You will be experiencing the following:

- Having a property that is in negative equity

- Having a property that is costing you every month to hold

Now you can sell but it will cost you capital to get out. I would not advise this as you are realising a capital loss. Property is a long term investment and prices WILL recover so there is no point in realising a loss if you able to. So the only strategy left to you is to fund the difference every month from your own pocket. This requires cash. Ways to raise cash to fund the monthly shortfall are to:

- Liquidize assets you have now

- Save some of your income you earn now

- Increase your income

- Liquidize Assets You Have Now

Here is a list of assets that you may have that have some value to someone. That is to say that you could sell, liquidize or cash in on these assets and raise cash, as there is a ready market for these type of assets. The best place to advertise these items are in the local press, internet or papers such as loot or Ad-Trader. If you cant be bothered then take the items to dealers in your area.

| Asset | Justification |

| Cars | How important is the car you have for your day to day activities? Do you commute to work by public transport Monday to Friday, drink at the weekends and only use the car to ferry your weekly household shopping? Have you ever considered getting a taxi or shopping online? All the major supermarkets offer online shopping – some offer free delivery. If the car’s not that important you can raise cash from the sale of the car plus save on the ongoing running and maintenance costs. Running a car costs anywhere from £50 to £500. This can easily rise to above £1,000 if you take in to account the HP payment if its on HP. Selling a car can have a dramatic impact on cashflow as not only does it raise cash - it saves cash. If the car is important to you then consider trading your car in for a cheaper alternative. |

| Jewellery | Do you have any jewellery that you no longer and never intend to wear? It is a waste to have these items. Look at these items as if they are cash. There are plenty of jewellery shops out there that have cash ready and waiting. Don’t worry if all it raises is £150 – its still £150! This all goes in to the kitty. Remember, you’ve got to start somewhere. |

| Furniture, Collections & Other Household Goods | Do you own an expensive record collection that you never touch? I know I do – but I don’t need the money now! When I was younger though I used to DJ. I would sell my old records (and when I say old, I mean 6 months out of date) to raise cash to buy up to date records. This kept me getting booked for gigs. Unused goods, collections, furniture or other items can just sit there and eventually end up in a boot sale, jumble sale or even worse – the rubbish bin. Are any of your goods that you no longer use that have a value now? Not only can you raise cash but you can also de-clutter you living space. |

| Electrical Equipment | TVs, Videos, DVD Players, Hi-Fis are easy ways to raise cash. Also the actual cassettes can raise you more than you think. There are many second-hand exchange type of stores, such as Cash Converters, that will pay you for these type of goods. |

| Obsolete Items | Look around your house and garage. Is there anything that you don’t use? Now does it have value? The best way to gauge if it has value is to ask yourself – how much did I pay for this thing! If it was substantial, say over £100, and you could imagine someone else using it then its probably worth something to somebody. |

- Saving Some of Your Income You Earn Now

There are really only two core ways of saving money:

A Going without i.e. not spending!

B Cutting costs i.e. spending less!

- A) Not Spending

I’m not going to bore you about how you should stop smoking, drinking, eating or just simply indulging. What you should do is when you get paid then pay out all your fixed costs first as these are non-negotiable. So the shortfall should be paid as soon as you get paid. What will happen is that you’ll adjust to the new level of spending that you have at your disposal.

Always ask yourself – do I really need this item that I’m buying now or do I just want it? Is it a need or a want? If it’s a luxury item then its probably a want. When I was setting up my property business I went without. Here a some of the things that I used to buy when I was at work but went without when I was starting self-employment:

- Newspapers & Magazines

- Use of a whole flat to shared accommodation

- CDs

- Designer clothes

- Meals at restaurants

- Nights out in London visiting trendy bars and nightclubs

It was easy for me to go without. In the back of my mind I knew that if I went without now I would have in the future.

- B) Spending Less

There are really only five things you can spend your money on:

- Food & Consumables

- Shelter

- Travel

- Entertainment & Clothing

- Loans & Savings Plans

Here are some tips on how to cut back on spending on each of these categories:

| Spending Category | Tip | Narrative |

| FOOD & CONSUMABLES | Eat in rather than out | Its so easy to go to down to your nearest Burger chain, Indian restaurant or Chinese take-away. There’s no washing up, it tastes lovely and there is no preparation time involved. However, you do pay for this! I used to make myself sandwiches in the poor days. 2 slices of bread, a bit of lettuce and a chicken slice – total cost 20p! Compare this to an Indian take-away costing £7 at least. Now I’m not saying don’t treat yourself. I treated myself to one Chicken Biryani from my local Indian once a week – but that was it. Invariably the food you will prepare at home will be healthier too. The irony is that even though I can afford to eat out every night I now choose to eat in as it is healthier. I even look forward to those chicken sandwiches now! |

| Go round your Mums! | Now this may not be possible for everyone. It depends on whether she is still alive, you still see her or if you live close to her. The principle is – don’t be ashamed to ask for help. My mum quite enjoyed seeing me twice a week (or sometimes more!) and likewise – there’s no cooking like your mum’s cooking. Do you have a brother, sister, nan, cousin or good friend that loves to see you? If you let them know what you are doing – trying to preserve your property portfolio, then you will be surprised, they are more than willing to help. Do not think you are a sponger! Always remember people who help you get to the top. As thanks my mum now receives an income from me that is in excess of her pension and she doesn’t have do a thing! | |

| Try non-branded goods | If you understand how supermarkets work then you will try this. A lot of ‘own brand’ goods are produced by the branded good manufacturers. So sometimes the quality is the same. Now I say sometimes! I have tried some of the non-branded goods and they taste awful but there are some own-branded goods that taste as good if not better than the branded goods. So give it a try. The cost savings can be up to 50%. | |

| Buy one get one free | Every supermarket does this. They sell goods at no profit or even at a loss to get you through the door. You can use this to your advantage. If you have the time you can go to every major supermarket and capitalise on all of their deals. I have to admit, I never had the time to justify the cost savings. But if you have a family and you are willing to stock up then I would estimate that you can reduce your shopping bill by 40%. | |

| SHELTER | ||

| Switch utilities suppliers | It’s a competitive market out there when it comes to supplying gas, electricity and telephone. Due to deregulation you can save up to 40% on your bills simply by switching and it is an easy thing to do! Look out for new tariffs for your mobile phone. Prices have only come down since there introduction and so there will always be a new tariff being introduced that will trump your existing tariff sooner or later. | |

| Shop around for contents insurance | The insurance market is a competitive one. Do not accept the premiums you have to pay just because you paid it last year. Get in contact with a good insurance broker to get you the best deal. Have you ever considered not getting insurance? Sometimes you can pay a hefty premium to insure not a lot – and even then you don’t get a pay out when you make a claim! | |

| TRAVEL | ||

| Sell the car | Owning and running a car is not cheap. You’ve got HPI payments, insurance premiums, road tax duty, petrol & oil costs, Servicing Costs and Repairs. That’s a lot of expenses! You could save a small fortune if you did sell the car. Do a feasibility test on the car. Work out how much you spend a month on the car and see if it is greater than if you walked, cycled, took the train or bus and took taxis. If it is - then its time to sell the car! Remember a car is a luxury item. Public transport is supposed to be getting better and providing better value for money so be brave – get rid of it! | |

| Downsize the car | Okay, it may not be practical to get rid of the car but how about downsizing it.

| |

| Try walking or get a bike! | If you don’t have a car but get buses, trains and/or taxis then consider walking or cycling. You will save on the fares and it will keep you fit! | |

| ENTERTAINMENT & CLOTHING | Shop in the sales, markets and charity shops | One of my good friend’s dad told me that he buys his winter suits in summer and his summer suits in winter. The key is to get value for money. If you’re shopping in a glitzy, air conditioned, fashionable part of town then you are paying for it! All their expensive rents, rates and décor they have to pay are ultimately paid by you because they charge you a high mark up on the goods sold. You’ll be surprised how well stocked some of the market traders are now. I still get most of my designer clothes from markets and superstores – not New Bond Street in London W1! |

| Think about if it’s a need or a want | As mentioned above you need to always ask yourself if it’s a need or a want? Do you really need to see the latest releases at the cinema or can you wait a year when they hit the Sky channels? Is the latest Kylie CD single with all the mixes really necessary or can you wait for her album? Do you really need the extra pair of trousers that are half price in the sale or are you buying them because they’re cheap? If you master this thought process alone then half the battle is won. | |

| When you go out – don’t stay out late! | I find that when I stay out later I spend more. More on drinks, food, taxis and club entrances. Go home early! I’m not saying just stay out for an hour or so but try to arrive early and go home early. You’ll find out that you’ll come home with some cash in your pocket rather than having to revisit the cash machines on the night out and regretting it later! | |

| Look out for the deals bars, clubs, cinemas and restaurants are offering | The entertainment market is a highly competitive one. Virtually every evening spot has an offer going on. Take advantage of this! Look out for flyers or leaflets available at their premises. Scan the local press for a restaurant trying to drum up a bit more business. Pay close attention to the TV ads when Pizza Hut and others are doing a promotion. | |

| LOANS & SAVINGS PLANS | Switch credit cards and loans to obtain the best deals | 0% APR for balance transfers – sounds familiar? I’m sure you’ve heard this so many times that it no longer means anything – but it does! It means that you can save a lot of cash as you pay no interest on your borrowing. Make sure you capitalise on these deals to save you real money. But don’t just be happy with saving money – make an effort to clear these balances! You will run out of credit companies eventually so you do need to clear this type of unhealthy borrowing. |

| Cash in or freeze payments to endowment policies and pension plans | Is the endowment policy you are contributing to really going to mature to its estimated value? You could cash it in, raise cash and save cash as you no longer need to contribute to it. It’s the same for pension contributions. You could freeze payments which will result in an instant saving. When I used to work I was tempted to contribute to a pension. But after careful thought I realised that under no circumstances was I going to hand over any of my hard earned cash to company that would ‘play’ with it on the stock market, be unsure of how much I would get back and never access until I was of retirement age. |

- Increase your income

I can already hear you – how do I increase my income? Well this depends on you. You need to be assertive, hard working and be just that little bit cleverer than the rest! There are eight ways that I can think of that will instantly increase your income. This does assumes you have a job or a business in the first place:

- Work extra hours

- Take on another job

- Ask for a pay rise

- Change your job

- Claim all benefits due

- Exchange benefits for cash

- Switch from permanent employment to sub-contractor

- Increase profitability

See, I told you - it depends on YOU! Lets look at these ways in more detail:

| How | Description | |

| 1 | Work extra hours | Are there possibilities to do overtime, work weekends or do nightshift work and get paid for it? You’ll probably find out that you will get in excess of your normal hourly rate but even if you don’t - still do it! If it means you earn more money then it all goes into funding the shortfall. As long as the opportunity of overtime exists then do it and use it for either payment or time to do things that will either make or save you money. |

| 2 | Take on another job | Do you do a 9-5 office job and have your evenings free? I know people that work in pubs and nightclubs that have an office job in the day. It’s a great way to increase your social circle. It also means you have less time to spend money as you are working! If you find a job that is a bit of fun then it will not seem that you are working day and night. What about setting up another small business? If you’re passionate about vintage clothes then why not start a market stall on a Saturday? If you’re a DJ then go down to you’re local bars and nightclubs and try and get a spot. Even if you don’t get paid you’ll save on the perks you get like free drinks and entrance costs. |

| 3 | Ask for a pay rise | The reason why men get paid more than women is largely due to the fact that they ask for more! If you think you are worth more then go knock on your boss’ office door and ask for a pay rise. Back your request up with what you have done for the company, market rate for your type of job and the loyalty you have shown to the business. I employ three people and I have one guy that frequently asks me for a pay rise – and I like that! He’s hungry to prove himself so I promise to increase his pay based on results. He’s had two pay rises already and he’s only worked for me for 8 months! |

| 4 | Change your job | This is an extreme measure but a valid one. There is no point staying in a job that’s below you’re perceived market rate. It breeds resentment to your employer and it drains your energy and motivation. Put your feelers out. Let your friends and family know that you’re looking. Scan the newspapers for the latest advertised jobs. Write to companies who you would like to work for. Ring up the personnel department and tell them you want to work for them. So get your CV up to date and start making some moves! |

| 5 | Claim all benefits due | The government has a multitude of benefits to claim even if you are working. There is the family tax credit for starters. Families can have both adults working and still be eligible for some form of credit. There is about £1 billion worth of unclaimed benefits every year. You’ve seen the TV adverts – ‘Its money with your name on it!’ |

| 6 | Exchange benefits for cash | You may have a company car that you use. Employers offer cash alternatives instead of the car. You may find that you can run a car cheaper than the cash alternative hence an instant saving and a positive effect on your income. Do you get any benefits from your employer that offer a cash alternative and you could provide to yourself cheaper than them? Its no point having a brand new car and struggling to meet the mortgage payment. |

| 7 | Switch from permanent employment to sub-contractor

| Usually this happens the other way round. If you’re a subcontractor earning £70,000 pa, and good at your job, the company offer you full-time employment for £45,000 pa. For this you get job security and access to employer benefits such as their health and pension benefits. This is an expensive price to pay. In this example, which is a real example as one of my good friends did this, you lose £25,000 for not much. Okay, he’ll get a redundancy payment if made redundant but you have to evaluate how likely is this. Its worth asking your employer, if it is an environment for subcontractor work, to consider you switching to subcontractor income from salaried employment. The increase in pay could be quite staggering. |

| 8 | Increase profitability | This is a book in itself! For those of you that have a business you should be looking always on ways to increase profitability. Some obvious ways are:

Now it all depends on your business and how practical this is. But it is worth a think. Look over all the lines of your Profit & Loss account and see if you can either increase turnover or decrease expenditure or even both! |

Ensure that if you are on a repayment mortgage then you switch to an interest only mortgage as this will lower the monthly payment quite dramatically. Now knowing how long you’re going to have to fund this shortfall would be nice. What you want to know is how bad this coldspot is going to be and how long is it going to last. You need to be aware of certain key variables so you can gauge the likely damage of being in the coldspot environment. The following variables in the awareness table play a key part in determining how long and how bad the coldspot will be:

| AWARENESS TABLE FOR CHAPTER 7 | |

| Global Rates | Our rates are restricted by global rates. We cannot be out of sync with the rest of the world. This is called interest rate parity. The formula holds: Where S is the spot exchange rate, expressed as the price in currency A of one unit of currency B. F is the forward rate, and are the interest rates in the respective countries, and T is the common maturity for the forward rate and the two interest rates. It assumes that if interest rates were 10% in Europe then we would convert all our Sterling to Euros, place them on deposit in a European bank and then convert them back after a year and enjoy the profit. This theory states that the profit would be nil as it would be money for nothing and so when you converted back in sterling you would get an inferior exchange rate. So we are all locked within each country’s interest rate. The world has been in a recession. Interest rates have been low in the major economic countries which has kept our rates low even though we are not in a recession. Once rates start moving upwards over the borders then our rates will rise. You need to be aware of the financial indictors of the major economic countries. They will be the same as ‘Home Rates’ see below. |

| Home Rates | Taking into account the interest rate parity above there will still be some freedom within the UK to set rates. The rate is set by the Bank of England and they use the following reports to set them:

Keep abreast, where possible, of the UK and Global reports surrounding their economies. Here is where you will be able to see the triggers to movements in the UK and global interest base rates. |

| Negative Equity | If there are a significant number of property owners in negative equity then this reduces the feel good factor. In turn it reduces spending and productivity. This can trigger a recession which results in higher unemployment and a fall in property prices. |