CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

9pm……its getting warm

So we have seen a rapid decline in property prices. Repossessions are higher than they’ve ever been in the last 5 years, negative equity has swamped the nation – who in the hell would want to get in to property investment? Well to be frank – not a lot of people! The only people that are, are people like me. Professional investors hate having money in the bank. There is absolute no excitement in keeping your money in the bank. The return is guaranteed of two things:

- a) its certain

- b) its low

Basically its certainly low! If you are a true business man you would never accept a low return on your money even if it was certain.

So amongst the carnage below that is happening within the property market the vultures, being the professional property investors, hover above waiting to swoop. The professional investor will know that it’s a buyer’s market rather than a seller’s market. He will accelerate the fall in prices as he knows at what price will put money in his pocket. So for example if he sees a property advertised at £100,000 and knows that the property is worth buying at £85,000 then considering it’s a buyer’s market he will simply place a cheeky offer of anywhere between £75,000 to £85,000. If the vendor is desperate to sell he will entertain this offer so as to limit the damage of holding this property.

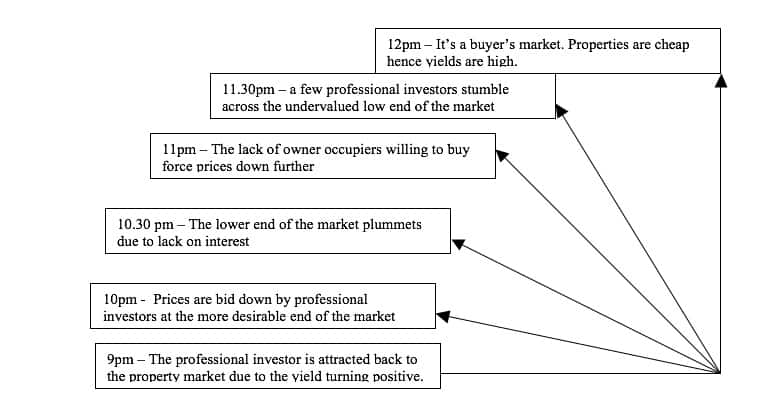

9pm to 12pm

Interest rates have peaked. Property has got a bad name. Property investment is now considered a stupid thing to do. People that had bought properties to then sell, banking on historic growth rates, are now left with a hot potato. For the fortunate people that have money and who want to still speculate are heading towards their nearest stock broker to play the stock market. The professional property investor however, never favouring the stock market, watches property prices on a daily basis to see when the price falls to a level that will put money in his pocket.

So who buys at 9pm? Well it’s the professional property investor who will accept the lowest yield. In my experience the lowest yield will be a 2% loading on the current borrowing rate on the most desirable rental properties. So if the interest rate is 8% and buy to let mortgage rates are 9.5% then the lowest yield acceptable will be 11.5%, being 9.5% + 2%= 11.5%. His reasons for choosing the most desirable rental properties is because a 2% loading does not allow for too much void periods. Look at this example:

There are 2 properties for sale, with current rents and corresponding yields:

| Advertised Price | Rent | Yield | |

| An ex-local authority studio flat | £60,000 | £6,000pa | 10% |

| A private 2 bed house | £100,000 | £10,000pa | 10% |

Due to the yields being equal the professional investor will assess the likely voids of both properties. With the ex-local authority studio flat it will be likely that the tenant will out grow the flat quickly as it is only a studio flat. Also, being an ex-local authority flat, it will only appeal to a limited audience. A 2 bed private house will be a decent sized living space for a single person, couple or 1 child family and it will appeal to a wider audience due to it being in a private area. He will estimate that the voids will be longer with the ex-local authority studio flat compared to the 2 bed private house.

However, the yield is below his target of 11.5%. He has to buy the property at:

£10,000 = £86,956

11.5%

to ensure that he gets a 11.5% yield. So the professional investor will go in with a bid of around £80,000 (as professional investors are cheeky and do not care if they offer 20% below what the vendor is asking!) and will happily negotiate at a price of around £87,000.

Sometimes vendors will accept less than £87,000 as they are desperate to sell thus pushing prices down further. So in the above example an offer £80,000 might get accepted thus setting the new price levels for 2 bed private houses.

Ex-local authority studio flats need to come down even further! As this is at the undesired end of the market professional investors may require a loading of 6%. If borrowing rates are 9.5% then a yield of 9.5% + 6% = 15.5% will be needed from the most cautious of investor! This equates to:

£6,000 = £38,710

15.5%

So a bid of £38,710 is all that the professional investor will pay. So prices have fall further.

Now notice that I have not mentioned the owner occupier in all of this. The owner occupier does not operate to fundamentals. The owner occupier will be solely focused on the property price itself. If he sees prices falling then his worst fear is buying a property that immediately falls in value. The owner occupier will wait till prices bottom out. The problem is the owner occupier doesn’t spend everyday doing this like a professional investor! The professional investor does as its his livelihood. The owner occupier has other things to do – like his job!

Property prices will continue to be bid downwards. The best rental properties being bought first with the lower end rental properties having to fall further. New entrant professional investors will enter, with higher loadings on their requirements causing the prices to fall further but the lower end of the market just simply having to fall further to attract any interest. There comes a point however, when prices at the lower end of the market catches the eye of one investor (someone like me!) who think – hang on a second, these properties are CHEAP! They start to buy where the market has bottomed out and as a result provide fantastic returns. So fantastic that other investors get wind of it and before you know it – the clock strikes 12pm!

So here we have the complete loop. As the clock strikes 12pm then we are simply back to a hotspot. Then all the principles in chapter 5 are applicable.

Looking at it as a sweeping hand of a clock:

Strategies Within A Warmspot

The key strategy is to bid low. Do not be scared of insulting the vendor with your offer. An offer is an offer no matter what price you bid at. Its up to them to say yes or no. At least your offer is on the table for them to consider now. It may get rejected now but accepted a few weeks down the line. Do not wait for the prices to fall to your desired level – this is apathetic! Its up to you to drive the price down. If you simply wait it is likely that another investor will get there before you.

Making Your Offer Stand Out

Now if you’re going to bid low, then make sure its serious. Not seriously low but a serious offer worth considering. A vendor may accept a lower than anticipated offer if it is one of the following:

| Type of offer | Description |

| A cash offer | This will mean that the sale, theoretically, will happen quickly as there is no mortgage to be obtained. This will mean no survey to highlight any potential problems with the property. If a vendor knows there will be no complications with regards to the finance then the vendor will favour this offer. Sometimes vendors favour a lower cash offer than a higher mortgage offer. It simply eliminates the lender from the transaction as we all know lenders can be awkward even at the best of times. To back up your cash offer show them your bank statement to prove you have the cash. This will really improve your chances of the vendor accepting your bid. |

| Backed by a Mortgage In Principle | If you do not have nice tidy sum in your bank account to make a cash offer then get a Mortgage In Principle (MIP). This is where a lender has already credit checked you and has agreed to lend subject to the property only. This will send out the message to the vendor that you have already done the preliminaries to get the finance. All that is required is that the property gets valued up to the agreed price and the property is suitable security for mortgage purposes. |

| A flexible offer | Sometimes if you can be flexible in your offer this helps a lot. If the vendor says that he is happy to accept your price but wants to move out in 6 months time and you are in no hurry to acquire the property then they are likely to consider your offer. Some vendors wish to take certain fixtures and fittings with them that the normal purchaser would not expect like fancy doors or fireplaces. If you allow them to do this, stipulating that they replace or make good the damage the may cause as a result of taking these fixtures and fittings then they may be more interested in your offer. |

Financing

You may well find that obtaining finance in a falling market may not be that easy. This is because the banks would have got their fingers burnt due to defaulters in negative equity. Lending criterias will be stricter. They may require:

- a larger deposit – to lower the risk to the lender. If, for example, they restrict lending to 50% Loan To Value then the property price will have to fall by 50% before the bank starts to get worried. This will be a big problem for you as you have to come up with the other 50%!

- Full status – instead of the bank lending on the strength of the property to pay the mortgage they may look at the property AND your status. They may ask that you earn in excess of £50,000pa and that you can prove it. This will mean payslips, tax assessments or certified accounts.

- A proven background – as the banks become more cautious they may restrict lending to professional landlords only. This may be decided on how many years you have been in the business or how many properties you have got.

So to ensure that you are able to buy within a falling market you need:

- Cash – cash is needed for a deposit. More cash may be needed than expected. Ensure that you’ve remortgaged yourself to the hilt! This means that you will have the cash to put down. You do not want to be in the situation where you can get a flat for £25,000, that rents out for £500pcm (24% yield!) but you cant raise the 50% deposit (£12,500) from one of the few lenders still remain in the buy to let market. Once the market recovers you will be able to re-access the £12,500 (and more!) put down as lenders warm back to the idea of buy to let. Once the flat recovers to £50,000 and lenders are willing to lend 85% Loan To Value then your £12,500 put down will raise an extra £30,000 to buy further properties ((£50,000 x 85%) – (£25,000 x 50%) = £30,000).

- Status – Make sure you can prove your income. If you are employed then be in a good job. If you are self-employed ensure that you have been so for 3 years and you have certified accounts.

- Experience – make sure you’ve got a well performing portfolio under your belt. The threshold is usually around 5 properties and 3 years experience. This will make you stand out from the rest.