CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

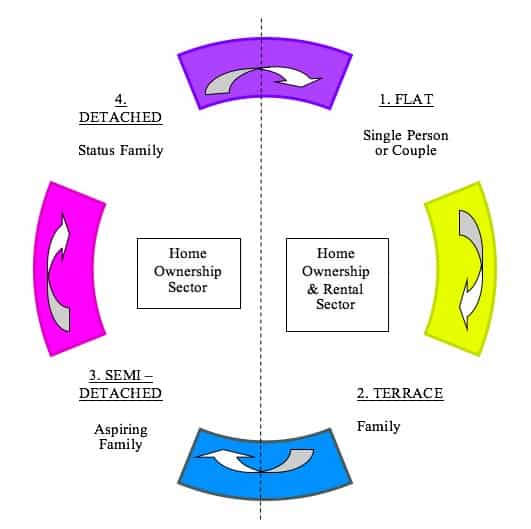

Since we are interested in property investment we must see how the property clock is relevant to the lifetime property clock. Its quite safe to say that the home ownership and rental sector will be made of properties in stages 1 & 2 and the home ownership sector only will be made up of properties in stages 3 & 4. Looking at it diagrammatically:

Just check out the rental lists of letting agents. They will predominately be for flats and terraced houses. There will be a few semis and detached houses available for rent but 90% or more will be the standard properties such as flats or terraced housing. There are two reasons for this:

- Semis and detached houses are sold at a premium compared to a terraced property with the same number of bedrooms. However the rent achievable for a semi or detached house will not compensate for the premium paid. This lowers the overall yield of the property hence making it unprofitable. Professional investors will shy away from such investments.

- The only people able to afford such homes are people on their third time buy. The price of semis and detached houses will be set by the gains made on their original property ladder climb so it will price out a lot of speculative investors also. Speculative investors would like to buy these properties as they will let out easily and is a property they feel comfortable with but it will be out of their reach due to the high price these properties command.

Direct Interaction

Since investors can only enter in to stages 1 & 2 we can say that property investment directly interacts with stages 1&2. Stages 1 & 2 involve the:

- Young single person

- Young couple

- Young family

i.e. first time buyers.

Property investment used to meet the need of people who had no interest in buying and hence would rent the properties bought by property investors quite happily. In other words we were in equilibrium between first time buyers and investors. First time buyers were able to buy as well as investors. Now what is happening is that investors are buying properties that are suitable for first time buyers at a faster rate than first time buyers thus forcing them to rent their properties rather than to buy the properties. What then happens is that the rental sector grows and the home ownership sector shrinks within stages 1 & 2. If the home ownership sector shrinks too small it will effect stages 3 & 4 as there will be fewer buyers moving round the lifetime property clock. This will be the indirect interaction.

Indirect Interaction

The best way to understand this is to look at extremes. So in the extreme, if stages 1 & 2 was at a ratio of 100% rental and 0% home ownership then the prices of semis and detached would have to fall as no one would have a gain on their previous property to put down as a deposit. This will slowly drive the prices of executive homes down as there will be no one to buy them. the prices will fall to a level just above the undifferentiated terraced properties.

So the mix of investors to first time buyers is critical to sustain the prices of stages 3 & 4. It is NOT, however, critical to prevent a crash in housing. You may read a lot about the lack of first time buyers entering the market and somehow its going to trigger a crash but this is a red herring. It will only cause ridiculously priced houses at the top end of the market to come back down to a sensible level.

Strategies

I love to go where no one else goes! This is the way you make serious money. So as everyone talks about the lack of first time buyers and how they are priced out of the entry level of the market - you’re looking at the other end! Check out how fast the semis and detached end is falling. At the minute I have found nothing but that doesn’t mean there isn’t anything out there. ‘He who seeks will find’. One of my long term plans is to cash in my whole lower end portfolio and buy fewer top end properties as a nice pension policy. Now I say long term but if the semis and detached end starts yielding gross at 8 or 9% in a few years then this could be the way to go.

Look at this example, which is actually my real case:

Number of properties: 100

Property value: £6m

Debt Value: £3.5m

Annual Rent: £420,000

Annual Profit Before Tax: £180,000

Lets say I sell my whole portfolio I would net:

£6m - £3.5m = £2.5m

being the property value – debt value = net proceeds

Now if I could get 9% on this £2.5m from buying ten £250,000 higher end properties then my profit and loss account would look like:

Rent (9% x £250,000) £225,000

Mortgage Cost (no borrowings) £nil

Other costs (management, voids etc) £45,000

Annual Profit Before Tax: £180,000

Spot the difference? Well there is none! I would earn exactly the same as I would before. However, it would be a manageable portfolio since being only ten properties, a better class of tenant since its higher end properties hence less bad debt and lower maintenance due to being simply a smaller portfolio (less gas safety checks, actual floor space are etc).

There are two problems currently in achieving this:

- I cannot find any 9% yielding higher end properties.

- I would get clobbered with a large capital gains tax bill which is difficult to shelter.

These problems can be overcome. Firstly 9% yielding higher end properties will be available in times to come so its just simply a waiting game. Secondly the large tax bill can be treated as an expense and factored in so that you adjust the selling price to cover this cost. I am sure I will find a landlord that will buy my portfolio at my price when this time comes.

Good Luck

Property is essentially a simple game if you understand a few fundamentals. The key is to buy when it puts money in your pocket and if possible increases your wealth. I know you’ve heard this time and time again but property is a long term investment. If you treat it as such then you are on the long term path to property millionariedom. I wish you luck with all your future property purchases and I hope you bear in mind the property clock.

Ajay Ahuja