CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

Calculating Growth

There are many investors that invest in property solely for the growth. They are not concerned with making a rental profit (sometimes happy to make a rental loss!) but making an above average gain on their initial investment. Annual Capital Growth (ACG) can be determined by:

Current Market Value after 1 year of purchase(CMV1) - Purchase Price (PP) = Annual Capital Growth (AGC1)

Basically its how much your property has gone up by in a year of ownership. For future years ACG is:

CMVn – CMVn-1 = ACGn

In simple terms it’s the difference between the value of the property now and one year ago.

Understanding +/- Growth

Understanding why property prices rise and then fall is very important if we want to make money! It is property prices that drive yield NOT the other way round hence what affects property prices is everything. Property prices are volatile and rents are stable. Experts call the rise and fall in property prices the boom bust cycle. The boom bust cycle will be directly related to:

- The general economy and

- Land values

This is because property is:

- built on land, and

- bought with money

So a full understanding of the limited nature of land and the dynamics of the economy will enable you to see where we are in relation to the boom bust cycle.

Certain principles need to be explained before we enter the boom bust cycle.

| Principle | Description |

| Land is in limited supply | No matter what we do there is nothing to increase the supply of land greater than the surface area of the UK. Undeveloped land belongs predominately to the aristocracy or local councils. The ‘super rich’ land owners such as earls, barons and dukes own land that they have inherited from their ancestors. Local councils own land that was passed down through the Magna Carta in 1066. London is not going to get any bigger. What we have is what we’ve got. Due to this fact it will ALWAYS attract the speculator. Massive profits can be made by simply holding on to a piece of land and holding out till the surrounding land gets developed. |

| The population is growing | With a growing population means that there are more ideas, inventions and businesses hence more is produced which causes a pressure on land requirements to locate all the people and their businesses. Overall land values have to increase. |

| Increase in land values cause an increase in development of land sites | A land owner will happily hold on to a piece of land as there is no cost to him holding. If land values rise due to the overall state of the economy rising then he will be tempted to sell. Then either the land owner sells, at a profit, to a developer who then develops on the land or the land owner decides to develop it himself. |

| An increase in development of land causes an increase in infrastructure | As development occurs more services are required to service the developed areas such as train stations, better road links, schools etc. this causes the overall land values to increase further. |

| Due to the rise in land values saving increases | Considering that money can only be spent or re-invested the general public become attracted to the returns to be had from property developments and hence save. This results in people spending less on the high street and hence consumption falls. |

| The fall in consumption is hidden by the feel good factor | Because home-owners have experienced an increase in their home they use this security to borrow and spend it on the high street. This increase in borrowing to spend is greater than the amount saved to invest (mentioned above) thus overall consumption increases. |

| A trade deficit occurs as a result in the rise of consumption. | Imports exceed exports to cope with the rate of consumption. This causes a deficit and hence the government must raise rates to attract outside investment to finance the deficit. |

| As rates rise the returns from property look less attractive | The whole boom is due to property looking attractive to speculative investors because of capital growth. If rates rise property price growth stabilises and thus expected growth is no longer factored in to the overall return. |

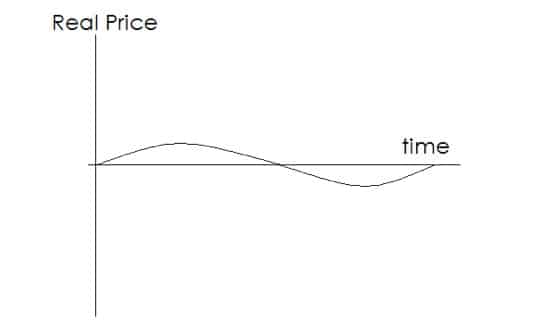

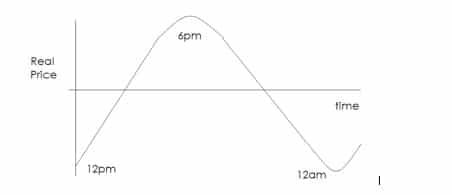

If the availability of land was not restricted then real prices would fluctuate like this:

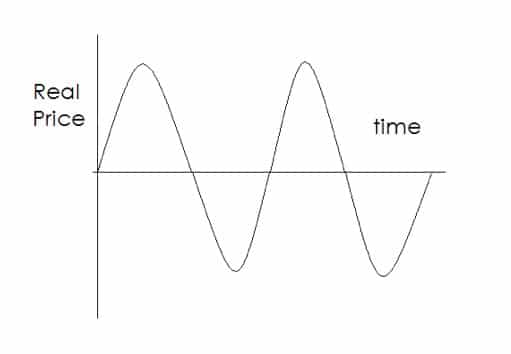

However, the availability of land to be developed on is restricted due to speculation, thus real prices fluctuate like this:

You can see that real prices rise and fall to a greater degree and over a shorter period of time.

You can see that real prices rise and fall to a greater degree and over a shorter period of time.

The Start of the Boom

Okay so lets start at when everything is at a sensible price. There are no rapid increase or decrease in prices, supply equals demand and so prices are stable. As the population is growing so is the demand by businesses and individuals to buy commercial and residential property. This means that:

- properties are either knocked down and built even higher (i.e. the number of floors) to accommodate the increase in demand

- properties are built in the undeveloped areas to cope with the increased demand

- Infrastructure increases to cope with the increase in population

This is what is supposed to happen but invariably doesn’t! Certain land owners do not develop and hold out for even greater increases in value. This in turn causes:

- Development in areas out of the city centre that put a strain on the infrastructure. i.e. if one can only build in a small village near the city centre then the road connecting the village to the city centre has to be upgraded and the construction of a train station in the burgeoning village is imminent.

- Undeveloped land in the city centre then becomes even more valuable because of the increased infrastructure surrounding the city centre thus creating a vicious cycle of surrounding villages becoming over developed and undeveloped land within the centre being worth potentially millions. Look at city centres with affluent village/towns surrounding it but with under-developed budget car parks within it being worth a fortune.

- Commercial and residential property within the city centre becoming over-enhanced i.e. knocked down and built again to a high spec (i.e. skyscraper) which costs a fortune to the investor but with the hope of an even bigger return.

- Developers buying sub-prime land to develop a long way in to the future thus bypassing greedy land owners with high prices on prime plots. However this money, invested by the developer, is removed from the economy.

So in all, due to the limited supply of land, rising prices being seen by everyone and the number of property programmes or friend’s stories of how they made a small fortune, its only a matter of time before - the property speculator emerges. The speculator assumes that you can buy a property, do nothing and sell it in a year and make more than the average annual salary!

Middle of the Boom

Due to the introduction of the speculator, who is really only a novice investor, property prices are over predicted. This means that:

- existing buildings can be sold to them at inflated prices or

- plots of land sold to developers (who are speculators also) re-sell the newly built properties to other speculators

because the speculator’s view is that the property’s value is heading in only one direction – UP!

As prices rise artificially high it encourages even more to be spent on them to gain a higher profit. This results in people saving more, to invest in property, and thus spending less on the high street lowering overall consumption. However this is masked temporarily by what’s known as the ‘Feel Good Factor’.

Due to some home owners feeling ‘richer’ they spend on the high street by obtaining unsecured debt such as credit cards or loans. They know that the increase in the value of their home can be accessed, by remortgaging, if they struggle to meet the debt. I’m sure we’ve all seen the newspaper and TV ads that dominate the advertising spaces offering all types of secured lending. So consumption is maintained by credit provided by the banks.

Towards the end of the Boom

As consumption is now fuelled by over-borrowing, consumption increases to an all time high. This causes a trade deficit to occur. This is because:

- Due to people saving to invest in property, money is taken out of the domestic economy and the production in goods at home naturally fall. Importation of goods abroad is the only way we can satisfy the increase in consumption.

- To also satisfy the increase in consumption we have to export less to further meet consumer demand.

So we end up importing more that we export thus creating a trade deficit. A trade deficit is where imports exceed exports. That is to say we buy more from abroad than we do from goods produced at home. As a result the government cannot raise enough revenue through taxes due to companies not producing enough to tax so the government has to borrow to pay for its spending. The only people that are willing to lend will be from abroad. To attract investors from abroad the government gilt rate has to be increased. This means raising gilt rates so that overseas investors will be attracted which ultimately results in rising interest rates.

At The Peak

Its not a pretty place at the peak! The following misunderstandings and interpretations are occurring:

- Investments are being made by speculators who are basing their returns on historical growth. Fundamental principles have gone out the window and investment decisions are being based on previous (and successful) speculative trades and success stories of other investors.

- Consumption is being fuelled by credit cards and 2nd charge secured loans by home owners feeling good AND the reluctance of the consumer to save due to continued increases in their property values.

- Lenders are lending on perceived equity to homeowners which are only as a result of speculation.

- Investing, consuming, lending and borrowing are in excess

- Interest rates are rising to cope with the trade deficit, consumer price inflation and to attract people back to saving.

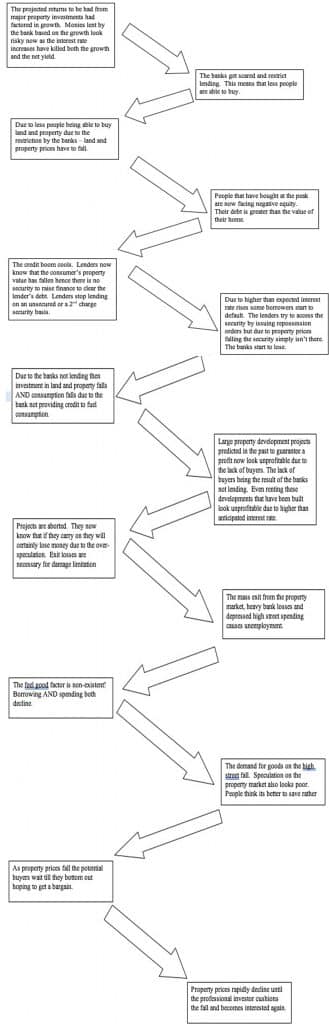

The Crash

Something has to cause the crash. Crashes do not happen overnight but they do happen a lot quicker than a boom. Think of a roller-coaster. You know that bit where you hiked up by the machinery to the top of the slope, you can hear the clunking, you get to the top, the clunking stops, you think the cart will rest at the top but it just tips over the edge………..

Well at the top of the slope the following will and can only happen and at a greater pace than the climb:

- Interest rate rises are increased to hurt! They are set to control inflation as we have been spending too much on the high street.

- With the increased interest rate the projected positive cashflows fall. This lowers the overall return on uncompleted capital intensive projects such as the erection of skyscrapers or new builds of luxury apartments.

- The calculation of possible investments now include the higher rate of interest rate and now no longer look so attractive.

- The property development market slows……

Now if all this speculation had been done with private money then we wouldn’t care. The problem is that its been done with other people’s money i.e. THE BANK’S! It’s the pulling of the plug by the bank that cause the rapid decline in property investment. Let me show you by a clear train of reactions:

Source: www.landvaluetax.org

This is why property prices move up and down as explained in chapter 1. Looking at the graph:

12pm being the beginning of the boom and 6pm being the beginning of the bust. Now I really want you to understand this boom bust cycle. It is the understanding of these fundamentals which will ensure that you NEVER lose in property investment. Please re-read this chapter as many times as it takes so you understand how the boom bust cycle works. Once you’ve understood this then we can move on to understanding yield which is the ultimate tool for any serious property investor.