CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

At The Start….12pm

Well the clock strikes 12pm – but there’s no gong! At 12pm hardly anyone knows the fact that this area is a gold mine. It’s a buyers market. No one wants these properties and there are plenty of vendors desperate to sell. You walk in to the estate agents saying you want to buy and they roll out the red carpet! These agents have become accustomed to only vendors walking in to their office wishing to sell but at last they have stumbled across a BUYER! You, with your hard earned cash and the bank’s money, want to buy big time.

So you ask the agent what has he got? He then proceeds to pull out of his filing cabinet details of over 20 properties all yielding in excess of 12%! You ask him what the areas are like and he says they’re fine. You’re not so sure. You are always told never to believe an estate agent. You flick further through the details and you’re seeing studios and 1 bed flats yielding in excess of 20%. You ask to view all of the properties and to your surprise he says no problem. He then books half the day to show you all the properties. A lot of them are empty as no one wants them as investments and some of the areas look a bit rough. However, you can be assured that it is only a matter of time before other investors follow and regenerate the area to a solid rental area.

Now you have to a brave man to buy when its 12pm. However, if you are brave, you will make the fortunes I have done as you have understood the concept of supply and demand. I had an email from someone who asked my advice. He was concerned that there was an oversupply of housing in Hull, East Yorkshire, and that if he bought a property it would not let out. I asked him well what would it be like if it was the other way round – there was an under supply of housing? He would not have been sending me the email as the property prices in Hull would be much higher thus not worth considering. So you have to go where there is LOW demand for property and wait for the demand to rise. And you can be sure they will rise as the only way is up.

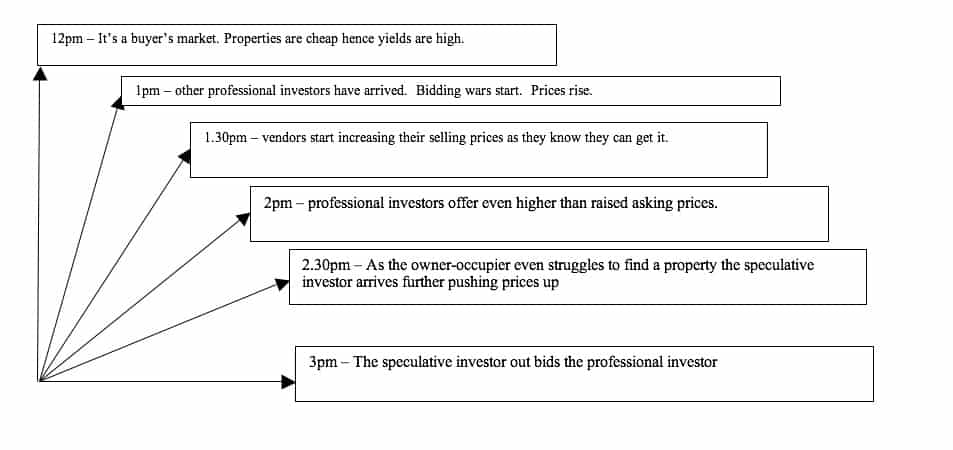

12pm to 3pm

12% - 20% yields are unsustainable. If you were to find such a place that remained at this level you would be silly not to plough all of your savings and future income in to this area. This is because you will make a solid £50,000 out of every £100,000 invested if you geared up and bought wisely. If you took a risk you could make far more. However a good thing never lasts forever. I will show you how it goes from 12pm to 3pm. That is to say that the area goes from +growth and +yield to +growth and –yield.

Lets just say that it is only me that has found this magic area that is yielding in excess of 12%. So I buy as much as I can afford from every estate agent in the area. As soon as something comes on the market that meets my criteria I buy without hesitation. It wont be long before another professional investor finds this area too as there a number of professional investors looking for these exact areas! Some professional investors have a high buying quota, sometimes in to the hundreds. Even I have a high quota, typically around fifty, but there are much bigger sharks out there. So when other professional investors get wind of this magic area a bidding war commences.

It starts with properties being sold within 24 hours of the property coming on to the market at full asking price. This sends signals to the vendors that they are selling their properties too cheap so they increase their selling prices. Usually the vendors under estimate how much to put up their prices by (due to the market being stagnant only several months before and simply cant believe that they can get any higher) and professional investors pay over their asking price. This is because a professional investor has a set criteria to buy to. So for example I have a criteria of buying at 12% yield. So if I see a property for £30,000 and I know it will still yield 12% at £35,000, and it’s a competitive market then I would be silly not to offer £35,000 so as to ensure that I got the property.

What we then see is a rapid increase in prices. It’s all about who will accept the lowest yield. The market quickly changes from a buyers market to a sellers market. All why this is happening the owner occupier is trying to get a look in – typically first time buyers. They are even struggling to get properties as the investors are snapping them up before they’ve had a chance to even look at them.

Now, there are professional investors and owner occupiers bidding in this market. Prices have risen dramatically. The speculative investor now gets wind of what has been going on. He has heard the stories of dramatic price increases and properties selling for over their asking price. The speculative investor is now thinking that he can buy a property, hold for a year or two and then sell at a massive profit. Lets welcome the speculative investor as a new entrant to the market.

The speculative investor is not the most clever of investor. Its unlikely that he does this as a full time profession but as a secondary source of income to his full time job. He may never have bought a property before apart from the one he lives in (is this you?). This is where the errors start to occur. The speculative investor is not familiar with net yield and over-estimates what the property will return. He over estimates the rent, under estimates the void periods, mortgage payments and repairs. However, blinded by the historic growth the speculative investor will push prices beyond the reach of the professional investor (as the professional investor now knows at that price it is a negative yield i.e. the property will take money out of his pocket) and out bid the professional. Say good bye to the good times because now at this point - the clock strikes 3pm.

Looking at this as a sweeping hand of the clock:

Strategies Within A Hotspot

In a nutshell:

BORROW FROM EVERYWHERE AND BUY EVERYTHING!

This may seem a bit extreme. But this is the only way you win at this game. You’ve got to bite the bullet and go for it. Hotspots do not last for long. I’ve seen hotspots go to cooling spots in 3 months. I’ve made £200,000 in capital growth for literally 10 days work of finding the right properties. And the funny thing is that this £200,000 will be accessed to buy in another hotspot and I’ll simply repeat the process. This is how I have made a consistent £500,000 per year. So if you lock in your position in a hotspot early then you can sit back and watch your investments rocket as late entrants to the market bid prices up. The more you buy the more you make. Its as simple as that. This strategy has really only two real components:

- Borrow from everywhere and

- Buy everything

Borrow From Everywhere

You need to raise cash fast if you are going to exploit as much as you can within the hotspot. This cash will be used as deposits for each flat or house you choose to buy. Here are some quick ways of raising cash, starting with the cheapest first, to pump into a newly discovered hotspot:

Source | Cost | Narrative |

| Personal Assets | 0% | Assets that are no longer being used but have some resale value. This may be jewellery, cars, furniture, pieces of art, electrical equipment etc. The cost is nil as the assets are not being used but they could be used to realise some cash in order to invest. Look in the garage or attic - you may be surprised! Think about it like this – you’re trading in your Ford now for the Ferrari in five years time! |

| Savings | BOE Base Rate | You may have savings in a deposit account or cash ISA. If you use this money the cost will be the lost interest that would have been earned if you had left it in the account. |

| Endowment Policies or Company Shares | BOE Base Rate + 3% | You could surrender an endowment policy or liquidise a current share portfolio to raise the cash. I recommend you talk to your financial adviser and stock broker before taking this action as you could be better off holding out on some of these policies or shares. But it could be time to let go of some poorly performing stocks and enter the property arena as so many of the share market investors are doing now. The cost of this on average is equivalent to the average return the stock market delivers. This, of course, will be different depending on the type of policy or stocks you hold. |

| Borrow from Family | BOE + 4% | You may have a family member who has cash sitting in the bank and is willing to lend it to you. You can offer them a better rate of return than any deposit account could. If he or she is a close member of the family they may lend it to you for 0%, but if you proposition a family member offering BOE+4% you might get quite a few more positive responses than expected.You could access your inheritance early, as many families do, to avoid inheritance tax. As long as the donator lives seven years beyond the date of the gift there is no inheritance tax to pay and is thus beneficial to both parties. A family member may be more willing to give you assets if you are proposing to invest it further rather than to just simply squander it on a new car or holiday. |

| Secured Borrowings | BOE+2-7% | To do this you must already own a property. The cheapest way to do this is to remortgage the whole property and release the equity tied up in your home. It pays to shop around. A good mortgage broker could probably beat the current rate that you are paying now and even reduce your monthly payments whilst still raising you some cash on top.The other way is to get a second charge loan where you keep your existing mortgage and borrow on the remaining equity on the house. You’ve probably seen the TV ads promising you a new car or holiday just from one phone call. Well forget a new car or holiday – we’re going property hunting! |

| Unsecured Borrowings | BOE+2-15% | The cheapest way to do this is by transferring a current credit card balance to a new credit card with introductory rate offers. You draw out as much cash as you can on your current credit card and then apply for a credit card that has a low introductory rate for balance transfers until the balance is cleared. Once your new credit card has been approved you transfer your existing balance on your old credit card to the new credit card at the introductory rate, typically BOE+2%. This rate is fixed until you clear the balance.You may, however, not get this new credit card. The other way is to draw down the cash on your existing credit card at the credit card rate. This can be expensive but if the property you have found has a high income yield you could use the cash on a short term basis, say one to two years, and use the profits to clear the credit card balance. You may be able to arrange an overdraft with your bank or a personal loan at around BOE+6%. You need to speak to your bank manager. You can also go to other unsecured lenders but there are high arrangement fees and the interest rate can even go up to BOE+35%! You need to shop around but I would advise steering clear of anything with an interest rate higher than 25% unless you are really desperate and the property you have found has a very high income yield. |

| Get a partner | Dependent | The other way to raise the cash is by taking on a financial partner. This means that the financial risk is borne by the partner but you end up doing all the work. The partner will be entitled to a share of your profits and you will not be free to do what you want with the property. Equating the cost to you will depend on how successful the property is as the cost will be the share of profits made. Even though this is the most expensive way to finance a property business it can also be the cheapest way if the whole project fails as your partner has taken the full financial risk. If this is the only method you can use to get into property I would still advise taking on a partner as you will still be participating in a share of the property market. |

This is not an exhaustive list. You may have other good ideas for raising finance but if you can’t raise the finance then you can forget the ‘get rich quick’ dream. It’s as simple as that. You need money to make money. The great thing about property investment is that you do not need that much to participate. This is because the majority of the purchase price is funded by the bank (typically 85%). So if you want to buy £100,000 worth of property you need £15,000. If property prices double in a year (which happens sometimes in hotspots) then your £15,000 makes you £100,000. That’s not bad for doing nothing!

Buy Everything

Don’t hang about in other words. Check how much cash you’ve got AND what you can get your hands on to work out how many properties you can buy. Once you have a set quota then see everything that’s on the market. The way you get to see everything so you get the best of what’s available is:

| Action | Why |

| Get on every estate agent’s mailing list | Find out all the contact details for every estate agent in the area. You can get this by visiting www.yell.com. Ring them up and tell them you are looking for properties up to £xxx,000, any type and any area. This will ensure that you will get a constant flow of opportunities through your front door every other day. |

| Ring every estate agent | Properties come on to the market before the details have been printed. The only way you are going to find out about these properties is if you ring up and ask if anything new has come on since you last received their mailshot. |

| Visit every estate agent’s website and set up email alerts | One way of getting details before they go to print is to go on the agent’s website. If the agency is run well the site will be updated regularly and if you sign up with their email alert system you will instantly get the details of the new property as it is added. Some agents even have mobile sms text alerts! |

| Stay up there for a week | You may be competing with locals in the area. The only way you can compete with them is to be a local too! Find a cheap B&B, take a week off work and get hunting. A week’s work in a hotspot can earn you 4 times your ANNUAL salary – and more! |

| Pay someone to look on your behalf | If you do work fulltime and you have a high buying quota then pay someone (you can trust!) to look on your behalf. Get them to take digital photos and get them to email them to you. I do this and pay them £10 per property. If he finds one property worth buying out of 25 then he’s done well. He actually finds one property out of every two that’s worth buying so he does fantastic. |

| Check local press | Some deals I have found have been in the local paper. Some people hate estate agents and refuse to pay their high selling fees. Why pay over £1,000 to a slick agent when you can pay your local paper £10 for a small box ad? Scan ALL local press for property ads. |