CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

Property prices follow a cyclical pattern. Property prices rise and then property prices fall. The reasons why will become apparent further down, but for some reason they rise and then fall. So what is the best time for an investor to become interested? When the prices start to rise of course!

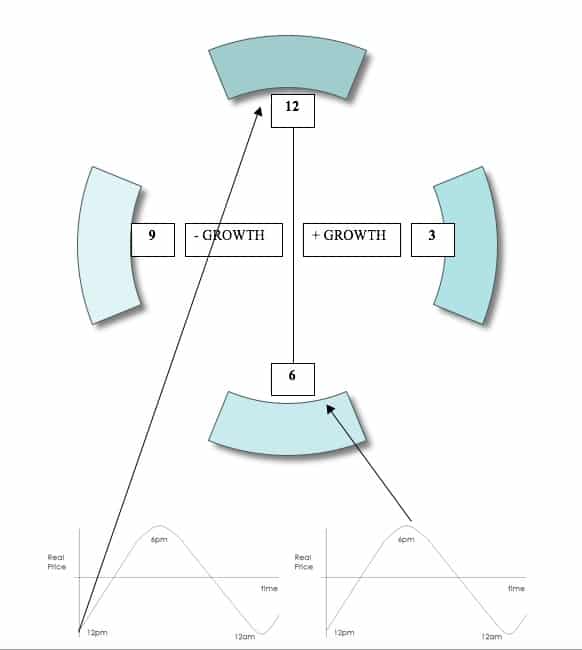

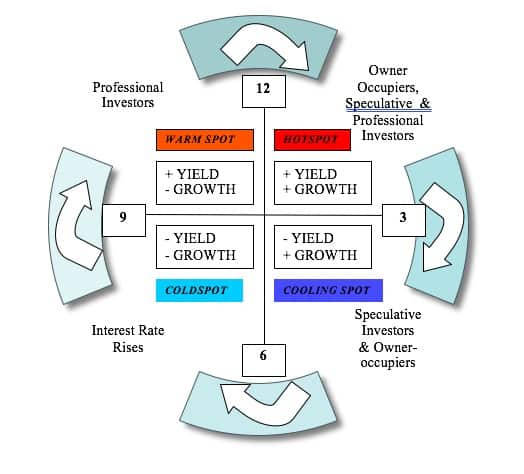

If we were to speed up this process over a notional 12 hour period, with 12 o’clock being the point at they first rise and 6 o’clock being the first point they first start to fall then we would have the following diagram:

So at 12pm prices increase until 6pm and then they start to fall. So we can see that anyone that has any sense gets interested anywhere between 12pm and 6pm. So who buys during 12pm and 6pm? Everyone! So who is everyone and why do they buy? The following people exclusively buy and their reasons are:

| Buyers | Why? |

| Professional Property Investors | A professional property investor will buy a property that will enable him to buy other properties AND put money in his pocket. That is it will enable him to benefit from capital growth so as he can remortgage and buy further properties and when rented out it will, after voids, letting agent fees, tax and other expenses provide a positive cashflow. |

| Novice/Speculative Investors | A novice/speculative investor will invest in a growth area because they will believe that the trend upwards in price will continue. They are less concerned in fundamentals as they are not aware of the fundamentals – they simply believe that the trend is upwards. |

| Owner-occupiers | The owner-occupier will buy because if they delay buying it will cost them more. So it is in their interest to buy sooner rather than later as their overall purchase price will be higher the longer they leave it. |

So who buys between 6pm and 12pm? Well prices are falling now so the Novice/Speculative investor becomes disinterested as there are no capital growth prospects and the owner occupier will wait until the prices drop further. The only buyer remaining is the professional investor:

| Buyers | Why? |

| Professional Property Investors | The only time a professional property investor will buy in this market is if the investment puts money in his pocket. He will invest in a falling market due to the property market providing him with a better return on his other investments such as the stock market, other businesses or a bank or building society. It is the professional property investor that prevents the property market falling to nothing. It is the professional investor that provides the cushion to the fall. |

Based on the table above we can see that:

- The professional investor buys on known information i.e. the property purchase puts money in their pocket.

- The novice/speculative investor and owner-occupier buy based on the fact that the trend of the prices are rising ONLY.

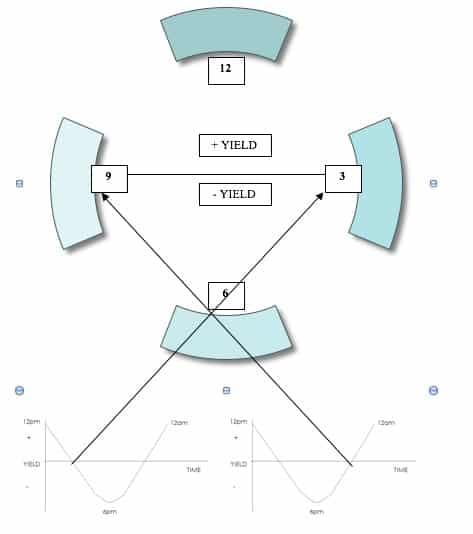

So how does the professional investor estimate whether a property will put money in his pocket? Well its called gross yield. Gross Yield, in mathematical terms, is:

Annual Rent .

Property Purchase Price

Now annual rent is a pretty static figure. Rents do not rise and then fall. They simply rise slowly and steadily the same way wages do. So in real terms they remain the same. However property prices are far more volatile. Property prices gather momentum far in excess of the rate of wage inflation and hence rise and fall greater than the rate of inflation - but we will get to that later.

Assuming we agree with the stability of rental prices and the volatility of property prices, we can show that:

Property Prices are inversely related to Yield

That is to say as property prices rise the yield falls. Let me show you this example:

Annual Rent: £10,000

Property Price: £100,000

Yield is then:

£10,000 = 10%

£100,000

Now lets say property prices increase to £110,000 in 6 months. A professional investor considering the market will now consider the yield to be:

£10,000 = 9.1%

£110,000

So we can see that as the property price INCREASES from £100,000 to £110,000 the yield DECREASES from 10% to 9.1%.

Using this same example lets say property prices fall from £100,000 to £90,000 in 6 months. A professional investor considering the market will now consider the yield to be:

£10,000 = 11.1%

£90,000

So we can see that as the property price DECREASES from £100,000 to £90,000 the yield INCREASES from 10% to 11.1%.

This is called an inverse relationship as the yield and property price move in different directions. So if we were to create a Yield vs Time graph then it would be the exact opposite of the Real Price vs Time graph.

Fitting the yield curves in to the clock it will look like:

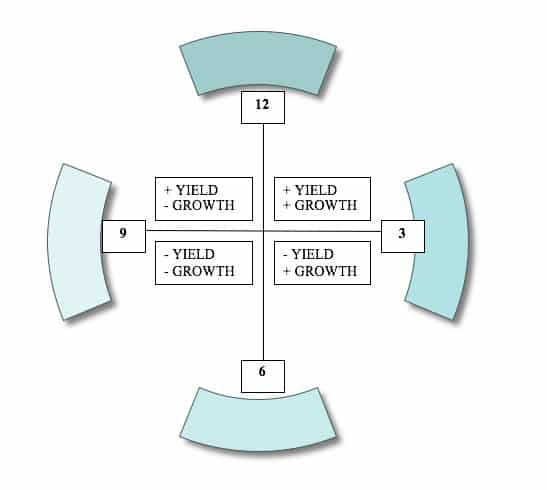

So if you’re a sensible investor then you will invest during 12pm to 3pm and 9pm to 12pm. This is because with any investment you make, you will make money as the investment puts money in your pocket because it’s a positive yield.

If we super-impose these two strategies then we come up with the face of the property clock:

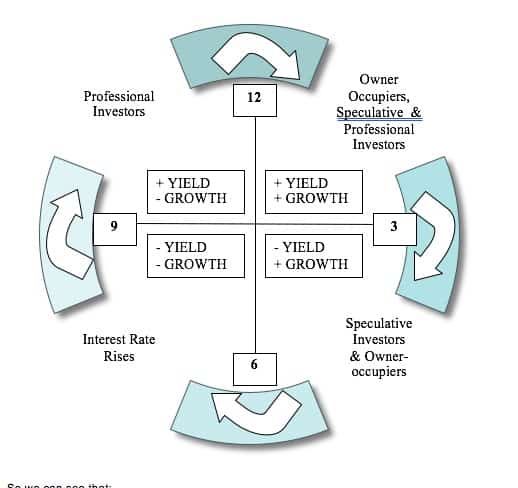

But with every clock it needs power to move round the face. These I call drivers. The clock needs power to take it round the clock. So what moves the clock round?

The following drivers push the property clock round with regularity:

So we can see that:

- everybody drives the price from 12pm to 3pm,

- speculative investors & owner occupiers only drive the prices from 3pm to 6pm,

- interest rate rises drive the price then downwards from 6pm to 9pm and

- professional investors drive the price downwards even further from 9pm to 12am but prevent the prices falling to zero.

The clock quarter regions (being 12pm-3pm, 3pm-6pm, 6pm-9pm & 9pm-12am) can be named quite specifically as:

| Clock quarter | Name |

| 12pm – 3pm | Hotspot |

| 3pm – 6pm | Cooling Spot |

| 6pm – 9pm | Coldspot |

| 9pm –12am | Warmspot |

The reasons why they are named so will be explained later. However, we have the complete face, drivers and names for each clock quarter for the property clock:

This clock is relevant to any property market that exists within a:

- Variable interest rate environment

- Easily obtainable buy-to-let mortgage

- Lack of long term fixed interest rate mortgages (typically greater than 10years)

The UK market fits this model. If any of these conditions are eliminated then the clock slows down. If all conditions are eliminated then the clock STOPS! Assuming that none of these things happen then the strategy is:

- Know when the clock strikes 12pm most importantly AND

- Know when the clock strikes 3pm, 6pm & 9pm

In the rest of this book I am going to ignore wage inflation. Even though a house costs twice as much in 20 years you can be sure that you will be earning twice as much. I am going to assume real prices. This makes the figures simple. Actual prices rise and fall but real prices remain the same.

Leave a Reply

You must be logged in to post a comment.