CONTENTS: 1 - THE PROPERTY CLOCK’S EXISTENCE, 2 - GROWTH, 3 - YIELD, 4 - PROPERTY PRICES: ACTUAL PRICES, REAL PRICES & BUBBLES, 5 - 12PM TO 3PM (HOTSPOT), 6 - 3PM TO 6PM (COOLING SPOT), 7 - 6PM TO 9PM (COLD SPOT), 8 - 9PM TO 12PM (WARM SPOT), 9 - STRATEGY SUMMARY, 10 - LIFETIME PROPERTY CLOCK, 11 - INTERACTION BETWEEN THE PROPERTY CLOCK AND THE LIFETIME PROPERTY CLOCK

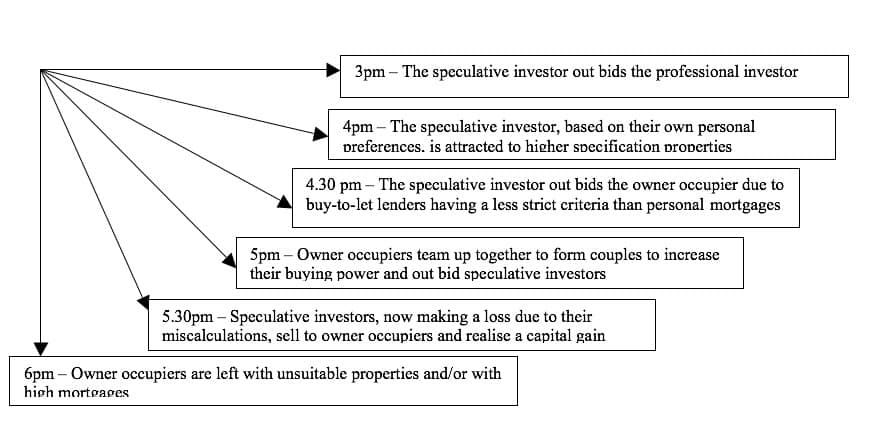

Cooling Starts….3pm

Picking up from the last chapter – the speculator has out bid the professional. So all that remain are the speculative investors and the owner occupiers. These type of purchasers have very different agendas. The speculative investor is looking to make money and the owner-occupier is looking for somewhere to live. Bearing in mind that the speculative investor is essentially a novice, his buying choices will be largely be drawn on his own experiences with property. This will be likely limited to purchases that he has made for himself to live in. In effect the speculative investor has the same buying requirements as the owner-occupier as they are the same being but with different agendas! The speculative investor will buy on emotion rather than fundamentals just the same as the owner-occupier. So he will be lured in to the same property developer traps as the normal owner-occupier falls into. Common errors made by speculative investors are:

- A higher purchase price will be paid by a speculative investor for a property that conforms to his higher décor standards disregarding the prospective tenant’s lower décor standards. The standard of décor that is required for rental properties will be over-estimated with the belief that the tenant will pay for this higher standard AND that the tenant will maintain it so.

- A bias towards private up market areas as the speculative investor feels ‘safe’ in these areas. A speculative investor will be typically earning above the average UK salary and will expect his tenants to be ‘young professionals’. What he fails to understand is that the young professional sector are either looking to buy themselves and may very well be a competitor for the type of properties the speculative investor is looking at. Or the young professional will have assistance from his or her parents in the buying process. Soon private developments become a fierce bidding ground with only one winner – the property developer!

- Properties that require refurbishment look like the only type of properties that the owner-occupier can afford due to their ‘perceived’ undesirability. Unfortunately only the opposite is true! Speculative investors look at the past historical growth and consider these type of properties another goldmine. They assume that after refurbishment they can make a nice tidy profit AND giving them the opportunity to display their interior design skills for all to see. Again the speculative investor over estimates the sale price and under estimates the repair work and bids higher than the owner-occupier.

- Assuming that a tenant will be grateful and less fussy when deciding on whether to rent a property. Box rooms will be tolerated by the owner occupiers but not by a tenant who may have to sleep in this box room! There is an arrogance element to the speculative investor for the tenant to be grateful for the high finish of the property even though the property is under-sized.

So as these two type of purchasers walk in to the estate agents the red carpet is definitely not rolled out! The estate agent would have seen at least 20 of you already and to be honest fed up with either of them saying “I’m looking for a property to buy to rent out” or “I’m looking for a property to get me on the property ladder” – Change the record! You, as a professional investor, look around at their display of properties on the wall, you see a property that looks cheap, but damn it says ‘UNDER OFFER’. You look further around and you see that all the properties on the wall are under offer or sold. You ask the estate agent what she’s got under £100k and she hands you one sheet. It’s a studio flat, requiring upgrading and its on a lease less than 50 years! Any property that looks mildly interesting is above £150k and yielding less than 6.5%. You leave, leaving the speculative investor and the owner occupier to battle it out.

3pm t0 6pm

So what causes an owner occupier to out bid a speculative investor? Well an owner occupier will buy a property based on what they can afford, a speculative investor will pay whatever covers his estimated expenses. So based on who is higher will win. Look at this example:

Advertised Property Price £100,000

Rental Value pa £7,000

The Speculative Investor

If the rental value is £7,000 then his mortgage company will allow him £7,000/130% = £5384. This is because any buy to let mortgage company will lend only if the rent is 130% or greater than the mortgage payments. He can now use the rent to pay the mortgage and benefit from the expected capital growth that he estimates at no cost to himself – essentially money for nothing! So at current borrowing rates of 5% the amount the speculative investor can go to is:

£5,384 = £107,680

5%

The Owner Occupier

The typical purchaser for this type of property looking to live in the property is earning £20,000. His buying power will be his level of deposit and the mortgage he can raise. Based on a £10,000 deposit and 4 times lending the owner occupier could stretch to:

£10,000 + (4 x £20,000) = £90,000

So we can see that the speculative investor wins and thus will out bid the owner occupier and push the price beyond £90,000 in to the hands of the speculator. So the speculator will get the property between £90,000 and £100,000. Then you are left with just the speculator battling it out between other speculators and thus pushing the price to £107,680. What the speculative investor has not factored in is:

- Void periods

- Tenant default

- Interest rate rises

- Repairs

- Exit strategy

The only thing that can push the price beyond the £107,680 mark is other owner occupiers increasing their buying power by teaming up together or by the individual seeking high income-multiple lenders. So in this example if you had two owner occupiers deciding to live together and buy, both on the same salary and deposit then their combined buying power would be:

£10,000 + £10,000 + (2.75 x £40,000) = £130,000

This assumes a 2.75 times joint salary which is standard within the mortgage market.

So now the properties value has risen to what a couple would be willing to pay for it. This couple could quite comfortably afford it even with expected interest rate rises as this is the home that they have chosen and their borrowing has been underwritten to be no more than 2.75 times joint salary.

So we can see there is a point when even the speculative investor drops out and is out bid by the owner occupier accepting a lower standard property. Even speculative investors that are holding now sell out to owner-occupiers as the speculative investors are losing money on a monthly basis (due to rents not covering the mortgage and other expenses) even though they are gaining on capital growth.

If it had been an individual seeking a high income-multiple lender then his buying power could have been:

£10,000 + (4.93 x £20,000) = £108,600

4.93 times individual salary being the highest income multiple I could find in the mortgage market as of today. This still outbids the speculative investor.

Looking at it as a sweeping hand of the clock:

Strategies within a cooling spot

The professional investor has dropped out of the market at this point. So if you consider yourself as a professional then the strategy is not to buy. If you want to make money in a cooling spot then you have no option but to buy and then sell. In other words you have to property trade. Now I am no expert on property trading and there is a good reason for this – I’ve never done it! It’s a risky game to play. I believe in the old mantra that property is a ‘long term investment’. A lot of money can be made but also can be lost. If you get your figures wrong and the market turns then you can get really stung.

However, considering it is the only strategy we have within a cooling spot, we best look at it in further detail. To make a profit from buying a property and then subsequently selling the property then the property has to experience capital appreciation. Capital appreciation can be amassed by one of three ways:

- identifying properties with foresight

- identifying properties with potential

1. IDENTIFYING PROPERTIES WITH FORESIGHT

Okay, so you want to be clever! If you don’t want to make money the easy way by identifying properties available that will lock in certain growth then lets play the speculative market. Property prices will rise, in real terms, due to:

An increased demand for:

- Unique properties that are scarce such as riverside apartments, 3 bed properties where there’s a glut of 2 bed properties, or houses in central districts as opposed to flats

- Properties that are considered ‘safe’ and more profitable investments to overseas investors compared to the what’s available back home

- An increase in a desirability of an area due to major employers locating in the area, improved transport links such as an a addition of a train station, tube or carriageway or improved services to an area such as a good school, leisure facilities or shopping centre.

- Properties being next to an area that is booming so as to make the area in question highly desirable as its cheaper than the booming area even after travel and time costs

- Properties being brand new and a qualitative effect being experienced due to new properties being most sought after

- An area undergoing a regeneration programme thus resulting in a general uplift in an area

This type of speculative investment is less certain. This is because you are either:

- not in full information, or

- asking the prospective purchaser of your property (even if you’re not selling it will ultimately determine the real value) – what are all these extras worth?

The reason why it is difficult to quantify these extras is because they are qualitative as well as quantitative. What is the true worth of a property next to a train station compared to a property 10 mins away from the station? Is it £5,000 or is it £50,000? It is this that determines the average selling price.

Take for example a riverside apartment on the north side of the river in London. How many properties are there for sale – say 10 properties. Out of those, how many need to sell? Very few. How many people are actively looking for a north side riverside apartment? Loads! So for scarce, highly desired properties – it’s a seller’s market. This means you simply have to wait for the buyer to come along unless you are forced to sell. The only reason for you to be forced to sell is if you need the proceeds to buy your next place or interest rates are on the up to the point you cant afford the mortgage payments.

If you have a desired property then you can wait for the buyer to come to you AND your price as long as you can hold out for a buyer.

Having a desired property like listed above will incorporate a qualitative factor within the price. Current thinkings say that there is no way to quantify these qualitative factors hence you can receive ridiculous amounts for seemingly basic extras such as being next door to a tube station, offering a brand new property or being next to a booming area as it is highly desired.

One thing I am noticing in the market these days is the increased value of time. There is a real perceived value in a property that is located in an area that saves you time on the commute. A property located 1 minute closer in travel time can have a disproportionate increase in value if measured to the worker’s hourly rate. This is because the worker’s leisure time is worth more than what they earn. Its worth looking at the properties that are or potentially able to save the buyer/tenant over 15 mins in commuting time.

2.IDENTIFYING PROPERTIES WITH POTENTIAL

okay, this section is for people who like to make money the hard way! You can add value immediately to a property if you are willing to enhance it. You can enhance a property in a number of ways:

- Refurbish it

- Extend the property

- Convert the loft

- Refurbish It

There is real synergy to be created if you get this right. Synergy means the sum is greater than its parts, or some people like to say 2+2=5. Let me explain.

Joe buys a house for £100,000. Spends £5,000 refurbishing it and sells immediately for £125,000. So he makes £125,000 – (£100,000 +£5,000) = £20,000. So in this example:

£100k + £5k = £125k.

£20k has miraculously appeared from nowhere! The reason for this £20k appearing is due to:

- Joe saving time for the buyer – if a buyer saw the property for £100,000 still requiring a refurbishment then the buyer would not be interested in it as he neither has the time to do the refurbishment nor the time to supervise someone to refurbish it.

- Joe having £5,000 to refurbish it and the buyer not – Joe is a businessman. He has £5,000 to refurbish the property and the buying power to buy the property. Whereas its likely the buyer will only have enough for his deposit on the property only. So on a 5% deposit of £100,000 a private buyer would need £5,000 to buy the property and £5,000 to refurbishment totalling £10,000. If the buyer buys the property after Joe has refurbished the buyer will only need 5% x £125,000 = £6,250. So the buyer needs less money to buy the property after refurbishment.

- Joe is an expert – Joe will probably have the contacts, know-how and expertise to get the refurbishment done cheaper than a private individual as he is in the trade. So if Joe views the property alongside an amateur investor Joe will cost the job at £5,000 and the amateur investor may cost the job at £8,000. With Joes ability to price the job lower than the amateur Joe can go in with a higher offer than the amateur – well in theory anyway! Due to programmes like Property Ladder, House Doctor, Selling Houses etc everyone thinks they are a property developer! So amateur investors are under budgeting for the refurbishment and over estimating the eventual selling price thus pushing the professional investor out.

Now I’ll be honest with you. I know absolutely nothing about the construction of property or refurbishment or building works! I have done refurbishments before only because the properties were so cheap and I couldn’t resist them. I bought a 7 bed property, yes 7 bed, for £42,000 in Corby. I never saw it but I heard it was completely vandalised inside as it was an old crack house. I knew that it could let out at £500 pcm after refurbishment so I thought it must be worth £50,000 at least. If the refurbishment would cost less than £8,000 then it makes sense. So I got a quote - £5,000 they said. So I said okay. That was my involvement in the refurb!

Now there are loads of books on how to add value to a property by making it look pretty and this ain’t one of them! If you want to play this game you have to look at the numbers carefully. You need to check there is a safe profit margin in it for you. So what is safe? You should always be prudent. That is you should always over estimate your costs and under estimate your proceeds. Look at this example:

There’s a property for sale for £100,000 that would be worth £150,000 if it was refurbished under current market conditions. The cost of the refurbishment is estimated at £10,000 and will take 2 months. I would adopt this forecasted profit & loss:

Selling price - 90% of anticipated selling price = 90% x £150,000 £135,000

Estate Agents fees 1% +VAT (£1,586)

Net proceeds £133,413

Costs:

Purchase Price £100,000

Refurbishment 150% x estimated costs £15,000

Loan repayments 6 months interest £2,500

Total costs (£117,500)

ANTICIPATED PROFIT £15,913

So prudently it will take you 6 months to make £15,913. Annualised its £31,826. Now is this worth your time? Are you worth more than £31,826 p.a. For me it isn’t but for you maybe. You’ll be surprised how people don’t do this simple profit & loss account to really see if a project is really worth their time. And remember its anticipated. It could be more OR it could be less!

Extend The Property

It is NOT a blanket rule that if you extend a property it increases the value of the property more than what you spend on the extension. It all depends heavily on where your property is located. I have created a rule of thumb measure of how much your property will increase by if you splash out on an extension.

Its all to do with the ratio of land to buildings cost. If you build on desired land then you win, if not you lose! So how do we find out if we own a property sitting on desired land. Well its all to do with the rebuild cost of your house. This you can find this from your buildings insurance policy which should have the rebuild cost stated. It would have been determined when you last had the property surveyed.

Now to decide if the land is desired you simply calculate the following ratio:

Current Market Value

Rebuild cost

If the ratio is greater than 1 then its desired. If its less than 1 then its not desired.

So if Jack has a property that is currently worth £100,000 and the rebuild cost is £60,000 then the Current Market Value Rebuild Ratio is:

£100,000/£60,000 = 1.667 which is greater than 1 hence Jack should extend.

If Jill also has a property worth £100,000 and it has a rebuild cost of £120,000 then the ratio is:

£100,000/£120,000 = 0,833 which is less than 1 hence Jill should not extend.

You should use this ratio as a multiplier to determine how much value will be added to the property. So in the above examples if they both decided to spend £30,000 on a downstairs extension then their properties, as a rule of thumb, increase by:

- x £30,000 = £50,000 for Jack

0.833 x £30,000 = £25,000 for Jill

So Jack makes £50,000 - £30,000 = £20,000 profit as a result of the extension

Jill makes £25,000 - £30,000 = £5,000 loss as a result of the extension

Now this is only an approximation. It all depends on how you extend, the choice of materials and whether you add a bedroom or a dining room. There are many books written on what adds value more than others and you should read them if you intend to extend. This multiplier should help you decide whether you should extend or not. If the multiplier is greater than 2 and you are willing to take on such a project then the decision to extend is a no-brainer i.e. yes you should!

Convert The Loft

Its difficult not to justify such an improvement to a property. They are cheap to do and add one of the most powerful increases to a property price – an extra bedroom! To calculate whether you should or you should then use the multiplier above but multiply it by 3. Let me show you using the same example above:

Jack’s multiplier 1.667 x 3 = 5.00

Jill’s multiplier .833 x 3 = 2.5

These are both Jack and Jill’s loft multipliers. So if Jack and Jill both spend £5,000 on a loft conversion then they can expect an uplift in the values of their homes by:

Jack: 5.00 x £5,000 = £25,000

Jill: 2.5 x £5,000 = £12,500

So Jack and Jill can expect to profit from their loft conversion to the tune of £20,000 and £7,500 respectively.

The Buyers In a Cooling Spot

There is no point in selling when your property is currently in a hotspot. This is because there is still room for the price to grow and its currently profitable thus its not costing you to hold. It only becomes worth selling when the property becomes unprofitable but the price is still growing. The highest point in the market can only ever exist within a Cooling Spot. This is because the property price has risen to the point that it is unprofitable but it is still on the trend upwards. The professional investor drops out of buying in this market and only owner-occupiers and novice investors remain.

You are able to sell within this market as it exists as there are owner-occupiers that are not concerned about the profitability of a property as they wish to live in it rather than rent it out. There are also speculative investors out there that are banking on the property price to keep on growing and the novice investor that doesn’t do his sums right. These buyers are able to buy your property at an inflated price above the real price because:

| Type | Ability | Reason |

| Owner-Occupier | Self-certified Borrowing | In the UK we borrow at the current variable base rate and not at the long term average rate. Currently the long term rate is around 5.7% and the variable base rate is at 4%. This is why we have a boom bust cycle. When rates fall below the long term rate first time buyers over borrow, as they can afford it, by obtaining a self-certified mortgage thus increasing their buying power. Their increase in buying power creates the bubble element as their buying power takes them over the real value of the property. |

| High Income Multiple Lending | Some lenders are offering in excess of 4 times salary. This enables a first time buyer to borrow in excess of the real value of the property thus creating a bubble element. | |

| Consumer Debt | Some people borrow the deposit for the property by way of loan. This means you can enter the property market very quickly as you do not have to wait to save up for a deposit. This increases the number of buyers thus increasing demand for property hence pushing up the price of the property. | |

| Novice Investor and Speculative Investor | Buy to Let | Due to the buy to let mortgage also operating under the current variable base rate the same problem occurs here. Instead of demanding a 2% loading over the long term rate they demand a 2% loading over the current variable base rate. This means you get novice investors buying at 6% yields and below hence superceeding the first time buyers highest price. Due to the poor performance of the stock market in recent years the property market has attracted the traditional stock market investor. Here the investor will invest for capital growth and so will be happy to take less than a 2% loading. The speculative investor will make the estimation that the growth experienced in the past will happen in the future over the short term. The speculative investor’s bid then superceeds the first time buyer’s bid hence a bubble element will exist. |

It is these type of buyers that do cause the bubble in the property market – so use them to your advantage! To find out about where all the hotspots, cooling spots, coldspots and warmspots are in the UK then visit www.propertyhotspots.net. This site also has a national yield and capital growth index for over 330 areas in the UK.

| AWARENESS TABLE FOR CHAPTER 6 | |

| Ratio of earnings to property value

| If property values are in excess of 4 times salary then you know that there is a bubble element to the property price. Try to get local data on people’s earnings to help you determine the real price of the property. |

| Lending multiples | Check to see if lending multiples are increasing. Currently the standard is 4 but there are a growing number of lenders offering 4.25 times salary and more which is causing the real price of property to rise. |

| Number of First time buyers | This needs to be a healthy number to keep the market buoyant - especially where the investors have refused to invest. If these stop buying then prices will fall in that area to the price that an investor would buy at. |